By Rhiannon Hoyle

The world's biggest miners, flush with profits from a recent

commodity market rebound, are grappling with a new challenge: how

to keep rising costs from eating into those hard-earned gains.

For much of this decade, mining companies have prioritized

reducing how much they spend to dig up each ton of the commodities

they sell, after a market slump made it harder to turn a profit.

Companies including BHP Billiton Ltd., Rio Tinto PLC and Glencore

PLC introduced drones and driverless trucks, cut tens of thousands

of jobs and sought advice from other industries including

automobiles to make their pits more efficient.

Now the sector faces a fresh cost crunch as prices for things

including fuel, wages and chemicals begin to climb. Energy bills

are rising following a more than 20% rally in oil this past year.

Raw materials including coke, which helps to fuel iron-ore

smelters, and caustic soda, used to extract alumina from bauxite,

are also rocketing in price. Workers are demanding higher wages in

many countries, including the copper mining hub of Chile, where

truck drivers argue better metal prices should translate to fatter

pay packets.

A depreciating U.S. dollar versus the currencies of top mining

countries is also putting pressure on margins, as commodities are

mostly sold using the greenback. The South African rand is up 22%

over the past four months.

"Clearly, inflation's becoming a bigger issue," said Anglo

American PLC Chief Executive Mark Cutifani. "So we've got to run

twice as hard." Costs are increasing for reasons similar to those

driving the commodity market turnaround: a healthier global economy

and rising demand.

Miners stripped billions of dollars in costs from their

operations as they sought to get a handle on budgets that spiraled

during the last commodities boom.

Between 2012 and 2016, copper producers globally slashed their

output costs -- the cost to produce one pound of metal -- by

roughly one quarter, according to data from S&P Global Market

Intelligence. Still, that followed a more-than-tripling of costs in

the decade prior to 2012. S&P projects copper output costs rose

in 2017 for the first time in five years.

Right now, higher commodity prices are certainly more than

offsetting higher expenses. Commodity prices have climbed roughly

20% since mid-2017, according to the S&P GSCI commodities

index, underpinned by a rare period of synchronized economic growth

in China, the U.S., Europe and major economies elsewhere.

Miners are making huge profits once again. Rio Tinto, the

world's No. 2 miner by market value, and rival Anglo American both

last month reported a doubling of annual net profit. Glencore said

it quadrupled its earnings in 2017.

With fuel and other necessary raw materials getting more

expensive, there will be pressure to find fresh cuts elsewhere to

protect margins, executives say. A further rise in mining costs

could provide an additional boost to the commodity market rally,

analysts say, particularly if investors bet on it causing some

smaller companies to pare production.

"The one thing that comes with inflation is a better commodity

price," said Anglo's Mr. Cutifani. But "we don't want to rely on

rising prices," he said.

Mr. Cutifani said Anglo will race inflation to cut the costs it

can, targeting an extra US$3 billion to US$4 billion in savings by

2022 through improvements to expenses, productivity and sales.

The return of inflationary pressures already sparked earnings

misses for several industry titans during the latest corporate

earnings season, dampening their stock-market rally. "Further cost

inflation in the mining industry is inevitable, in our view, unless

global economic activity slows," said Jefferies LLC analyst

Christopher LaFemina. BHP and Rio, among others, fell short of his

earnings forecasts because of unexpectedly high costs, he said.

Anglo American felt the sharpest sting in its South African coal

division, where costs for its export operations jumped 29%.

Rio Tinto forecast cost headwinds of US$300 million in 2018,

which would erase half its projected productivity improvements for

this year. "We will continue to be tough on costs," pledged Rio CFO

Chris Lynch.

Glencore Chief Financial Officer Steve Kalmin said the company

was seeing rising prices in diesel, steel and explosives, among

other things. There is also increasing competition for workers,

although it is "nowhere near where things were back in the 2007-08"

period when there was a scramble for basic skills, he said.

BHP Billiton cautioned of pockets of inflation in both its

petroleum and minerals businesses, although Chief Executive Andrew

Mackenzie played down concerns that renewed pressures would dent

the miner's bottom line.

"We, as a company, feel confident that we are able to quench

that and continue to drive our cost down," he said.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

March 12, 2018 06:44 ET (10:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

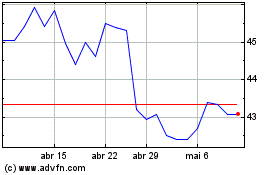

BHP (ASX:BHP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

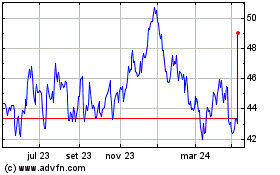

BHP (ASX:BHP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024