Brazil's Petrobras Posts Loss Following Settlement Charges -- 3rd Update

15 Março 2018 - 5:29PM

Dow Jones News

By Jeffrey T. Lewis and Luciana Magalhaes

SÃO PAULO -- Brazil's Petróleo Brasileiro SA, or Petrobras, said

Thursday it lost money last year as the state-controlled oil

company continues to suffer from the side effects of the Car Wash

corruption scandal.

Rio de Janeiro-based Petrobras reported a net loss of 446

million reais ($136 million) for the full year, after a loss of

14.8 billion reais in 2016. Petrobras said it would have had a net

profit of 7.1 billion reais in 2017 if not for some extraordinary

items, including one for $3.4 billion to settle a class-action suit

in the U.S. Petrobras reported a loss of 5.5 billion reais in the

fourth quarter.

Petrobras is recovering from the damage done by the corruption

scheme known as Car Wash, in which suppliers overcharged it and

funneled part of the money to politicians and their parties.

Petrobras in 2015 wrote off 6.2 billion reais due to the graft and

another 44.6 billion reais for overvalued assets, including

refineries, because of the scam.

The stock market reacted negatively to Thursday's numbers, with

the company's preferred shares down 4.2% in late afternoon trading.

Petrobras's operating results have improved, but the impact of the

settlement and another extraordinary item of 10.4 billion reais

related to a tax payment were a problem, according to Pedro Paulo

Silveira, chief economist at the Nova Futura brokerage in São

Paulo.

"There was good news in the report, but not enough to outweigh

the hit from the extraordinaries," he said.

The company announced at the start of this year an agreement to

settle the class-action suit filed by disgruntled shareholders, who

calculated the corruption scheme helped erase about $271 billion,

or almost 90%, from Petrobras's market value between 2009 and

2015.

The earnings figures show that "Petrobras is turning the page on

problems related to Car Wash," said Shin Lai, an investment

strategist at São Paulo-based research company Upside Investor.

"The change is happening and it's consistent."

Petrobras has been working to cut costs throughout its

operations, and its efforts are starting to show results. General

and administrative expenses fell 19% in 2017 to 9.3 billion reais,

mostly because of lower personnel costs, after Petrobras cut staff

through employee buyouts.

The company cut its net debt to $84.9 billion at the end of

2017, the lowest level for the figure since 2012, lengthened the

average life of the debt to 8.6 years from 7.5 years and reduced

the average interest rate to 5.9% from 6.2%. Those changes helped

cut full-year debt payments to 22.3 billion reais, from 25.6

billion reais in 2016, Petrobras said.

Write to Jeffrey T. Lewis at jeffrey.lewis@wsj.com and Luciana

Magalhaes at Luciana.Magalhaes@wsj.com

(END) Dow Jones Newswires

March 15, 2018 16:14 ET (20:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

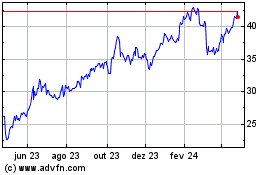

PETROBRAS PN (BOV:PETR4)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

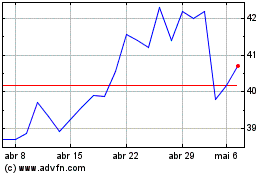

PETROBRAS PN (BOV:PETR4)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024