Qualcomm Investors Register Protest -- WSJ

24 Março 2018 - 4:02AM

Dow Jones News

Six board members get tepid support in holder vote following

Broadcom ordeal

By David Benoit and Ted Greenwald

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 24, 2018).

Six of Qualcomm Inc.'s directors, including Chief Executive

Steve Mollenkopf, failed to win support from a majority of the

company's shares Friday, a significant protest vote that signals

investor discontent after the chip-making giant successfully

rebuffed a hostile takeover from Broadcom Ltd.

At the company's annual meeting in San Diego, just 40% to 50% of

the total shares outstanding were voted in favor of the six

directors, with the other four getting more than 50%, according to

a person familiar with the count.

An 11th director, former Chairman Paul Jacobs, wasn't nominated

to stand for re-election after a dispute with other board members

over his desire to make a bid for the company.

All the directors will remain on the board since they were

running unopposed after the U.S. government blocked Broadcom's bid,

and by extension its six-member slate of nominees. The vote count

for the originally scheduled meeting that would have pitted the

Broadcom slate against Qualcomm's nominees showed Broadcom winning

at least four seats and with a path to get up to six, people

familiar with the matter have said.

The latest numbers are preliminary -- a tally will be disclosed

next week -- and subject to change.

Qualcomm investors had raised concerns about the company's

performance and how it handled Broadcom's $117 billion takeover

offer -- with anxiety over the latter stoked by the revelation that

Qualcomm had prompted the government review that led to the order

from President Donald Trump blocking the deal. Institutional

Shareholder Services Inc. advised investors to continue to vote for

Broadcom's nominees even though they couldn't be elected, as a sign

of protest.

While no one will be forced off the board by Friday's vote, such

a lack of support for directors often increases pressure on

companies to make changes.

The vote tally could have been worse: In a contested election,

winning some 40% of the total shares is often sufficient to secure

victory given many shareholders don't vote.

The tumult on Qualcomm's board follows a period of high drama

that started in November when Broadcom announced an unsolicited bid

for the chip maker, which has suffered a series of regulatory fines

and customer revolts including a bitter legal battle with Apple

Inc. over patent royalties. Qualcomm stock is down by more than 10%

since Apple launched a barrage of lawsuits early last year.

Singapore-based Broadcom's takeover attempt fell apart when Mr.

Trump accepted a recommendation by the Committee on Foreign

Investment in the U.S. to block it. That recommendation followed a

petition by Qualcomm in January seeking a committee review of the

deal.

CFIUS, which oversees foreign acquisitions of U.S. companies,

found that Qualcomm's large investments in next-generation cellular

systems are critical to national security and that a takeover by

Broadcom, known for cost cutting and financial discipline, would

risk ceding U.S. technology leadership to Chinese companies,

particularly Huawei Technologies Co.

Before the Trump administration's action, two services that

advise big investors in proxy contests had recommended that

Qualcomm shareholders vote for at least some of Broadcom's

nominees. One, ISS, maintained its recommendation to vote for four

of Broadcom's six nominees, even though they couldn't be

seated.

Qualcomm's meeting originally was scheduled for March 6.

However, CFIUS on March 4 ordered it postponed to give the panel

time to evaluate whether Broadcom's effort to control Qualcomm's

board would pose a national-security risk. The president issued his

executive order a little over a week later, disqualifying

Broadcom's candidates and forcing the hostile suitor to withdraw

its bid.

Mr. Mollenkopf has had a mixed record as CEO of the chip company

for the past four years. He has expanded beyond Qualcomm's core

smartphone modem-and-processor business and initiated the pending

acquisition of NXP Semiconductor NV to turbocharge the company's

prospects in automotive, security and connected devices. But he has

also presided over a series of business and regulatory problems. He

failed to head off attacks on the company's lucrative

patent-licensing business by Apple and Huawei, and probes by

regulators in the U.S., China and elsewhere -- challenges that

dented the share price and opened the door to Broadcom's takeover

attempt.

Mr. Jacobs, himself a former CEO of the company and the son of

Qualcomm co-founder Irwin Jacobs, last week alerted directors to

his own effort to buy the company, which he said would be better

off under private ownership. The board responded by announcing that

it wouldn't renominate him. It had stripped him of his chairman

title and his executive responsibilities the week before. It isn't

clear where his potential bid stands or whether he intends to keep

pursuing it. His former fellow directors, as well as many analysts

and investors, are skeptical he can pull it off.

Write to David Benoit at david.benoit@wsj.com and Ted Greenwald

at Ted.Greenwald@wsj.com

(END) Dow Jones Newswires

March 24, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

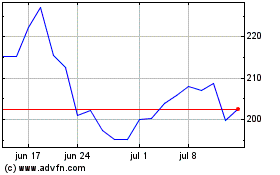

QUALCOMM (NASDAQ:QCOM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

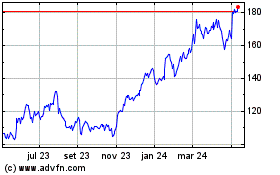

QUALCOMM (NASDAQ:QCOM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024