By Carla Mozee and Sara Sjolin, MarketWatch

Credit Suisse shares rally after earnings

Investors shoved European stocks lower Wednesday in the wake of

a selloff on Wall Street where equities were spooked by rising bond

yields and mixed earnings reports.

How markets are moving

Germany's DAX 30 index was the worst performing among the major

national indexes. It fell 1% to close at 12,422.30, suffering its

biggest daily loss in a month.

France's CAC 40 index declined 0.6% to 5,413.30, while the

U.K.'s FTSE 100 fell 0.6% to 7,379.32, breaking a six-session

winning streak

(http://www.marketwatch.com/story/ftse-100-drops-after-rising-bond-yields-spur-selloff-on-wall-street-2018-04-25).

The broader Stoxx Europe 600 index sank 0.8% to 380.18, pulling

further away from its highest levels since early February logged

earlier in the week.

The euro was buying $1.2176, down from $1.2233 late Tuesday in

New York.

The yield on Germany's 10-year bund was flat at 0.630%,

according to Tradeweb data, as prices fell.

Check out:Why the premium for German bonds over Treasurys is the

widest in 30 years

(http://www.marketwatch.com/story/why-the-premium-for-owning-german-bonds-over-treasurys-is-at-the-widest-in-30-years-2018-04-23)

What's driving the market

European stocks tumbled as traders globally fretted over a rise

in U.S. borrowing costs. The 10-year U.S. Treasury yield on Tuesday

touched the psychologically important 3% level for the first time

in four years and continued higher on Wednesday to 3.012%

(http://www.marketwatch.com/story/us-10-year-yield-blasts-further-past-3-flirts-with-highest-since-2011-2018-04-25).

U.S. bond yields have been rising on expectations that

inflationary pressures could prompt the Federal Reserve to ramp up

the pace of rate hikes, which would increase borrowing costs for

companies and consumers. European bond yields have also been

creeping higher. Higher yields can weigh on stocks as bonds start

to offer better returns than equities and raise borrowing

costs.

U.S. stocks also opened with losses

(http://www.marketwatch.com/story/stock-selloff-set-to-continue-as-10-year-yield-blows-further-past-3-2018-04-25)

on Wednesday, building on declines from Tuesday

(http://www.marketwatch.com/story/dow-shapes-up-to-break-losing-streak-but-earnings-could-kill-the-buzz-2018-04-24)

that were led by shares of industrial, basic materials and

technology companies after some mixed earnings from Caterpillar

Inc. (CAT) and 3M Co. (MMM).

Read:What it means for the market that the U.S. 10-year

government bond yield hit 3%

(http://www.marketwatch.com/story/heres-what-it-means-for-the-market-that-the-us-10-year-yields-3-2018-04-24)

(http://www.marketwatch.com/story/heres-what-it-means-for-the-market-that-the-us-10-year-yields-3-2018-04-24)Investors

in Europe will tune into what the European Central Bank will say

about economic growth in the eurozone on Thursday when the bank

releases its monetary policy decision.

Read:4 outcomes for the ECB meeting, in 1 handy chart

(http://www.marketwatch.com/story/4-scenarios-for-the-ecb-meeting-on-thursday-in-one-handy-chart-2018-04-24)

What are strategists saying?

"Equities continue to find it tough going at the moment, with

solid losses in the U.K. and Europe and U.S. stocks moving into the

red once more. Early signs of a possible stabilization before the

U.S. open were seen, but stocks swiftly fell once more," said Chris

Beauchamp, chief market analyst at IG, in a note.

"Earnings season continues to punish those with doubts about the

global outlook, as Twitter found out to its cost. A premarket jump

on headline earnings beats was sent brutally into reverse as the

firm's outlook for the year struck a distinctly gloomy note. This

is all very similar to Caterpillar last night, and the fact that

such disparate companies are being treated in such a similar way

speaks to a definite sense of unease among investors," he

added.

Read:Caterpillar shares reverse gains to slide 6% after CFO says

Q1 was peak for the year

(http://www.marketwatch.com/story/caterpillar-shares-reverse-gains-to-slide-6-after-cfo-says-q1-was-peak-for-the-year-2018-04-24)

Stocks in focus

Osram Licht AG shares (OSR.XE) tumbled 17% after the German

lighting maker late Tuesday cut its full-year target on earnings

before interest, taxes, depreciation and amortization.

Kering SA (KER.FR) bounced 4.6% higher as the luxury goods maker

said first-quarter revenue jumped 27%

(http://www.marketwatch.com/story/kering-revenue-soars-as-gucci-keeps-up-success-2018-04-25),

led by its flagship Gucci brand and "exceptional momentum" at

Balenciaga.

Credit Suisse Group AG shares (CSGN.EB) (CSGN.EB) rose 3.6% as

the Swiss lender said first-quarter net profit grew roughly 16%

(http://www.marketwatch.com/story/credit-suisse-profit-up-16-beating-forecasts-2018-04-25)

to 694 million Swiss francs ($709.1 million), beating expectations

of 653 million Swiss francs.

"With these first-quarter results, we got off to a good start in

our third and final year of restructuring," said Chief Executive

Tidjane Thiam said in a statement.

Metro Bank PLC shares (MTRO.LN) slid 7.3% as the U.K.-based

lender said its first-quarter profit increased more than fivefold

to GBP6.4 million ($8.9 million), but that its capital position has

weakened

(http://www.marketwatch.com/story/metro-bank-profit-soars-capital-ratio-falls-2018-04-25).

Shire PLC shares (SHPG) (SHPG) fell 2.8%, turning lower in

Wednesday trade. The drugmaker recommended shareholders accept

(http://www.marketwatch.com/story/shire-seems-ready-to-accept-latest-takeda-offer-2018-04-24)

an improved takeover bid from Takeda Pharmaceutical Co.

(4502.TO)

(END) Dow Jones Newswires

April 25, 2018 12:18 ET (16:18 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

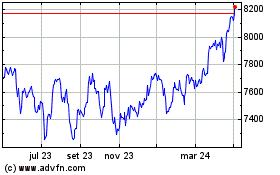

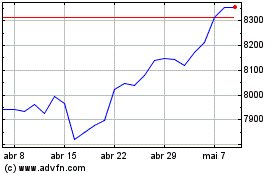

FTSE 100 (FTSE:UKX)

Gráfico Histórico do Índice

De Mar 2024 até Abr 2024

FTSE 100 (FTSE:UKX)

Gráfico Histórico do Índice

De Abr 2023 até Abr 2024