By Carla Mozee, MarketWatch

Bank stocks fall after ECB call

European stocks on Friday pulled back after scoring their best

session in a month, with bank shares under pressure and as

investors prepare for the U.S. to ramp-up its trade dispute with

China.

How markets are performing

The broader Stoxx Europe 600 Index fell 0.2% to 392.30, topped

by the consumer goods and industrial sectors. But the financial,

oil and gas and telecom sectors moved lower. On Thursday, the

pan-European index jumped 1.2%

(http://www.marketwatch.com/story/european-stocks-drop-as-investors-brace-for-ecb-update-2018-06-14),

its best gain since April 5, FactSet data showed, driven largely by

a tumble in the euro.

For the week, the Stoxx 600 was still on course to rise

1.9%.

Germany's DAX 30 index was flat at 13,105.9, and Spain's IBEX 35

dropped 0.6% to 9,989.20. The U.K.'s FTSE 100 lost 0.6% to

7,771.68.

Italy's FTSE MIB index shed 0.4% to 22,406.85, but France's CAC

40 index was up by 0.3% to 5,544.46.

Read: 5 key takeaways from the ECB's decision to wind down its

bond buying

(http://www.marketwatch.com/story/5-key-takeaways-from-the-ecbs-decision-to-wind-down-its-massive-bond-buying-program-2018-06-14)

The euro traded at $1.1590, up from $1.1569 late Thursday in New

York.

What's driving markets?

European bourses had a listless start before most moved lower

alongside a slide in U.S. stock futures . Those moves followed a

Reuters report that the U.S. government is nearly finished drawing

up the list of a second wave of tariffs on Chinese goods

(http://www.marketwatch.com/story/us-list-of-100-billion-more-in-china-tariffs-almost-finished-reuters-2018-06-15),

on $100 billion of products.

U.S. President Donald Trump late Thursday approved a first round

of levies

(http://www.marketwatch.com/story/trump-oks-around-50-billion-in-tariffs-on-chinese-goods-2018-06-14)

on about $50 billion in Chinese goods. Details of the initial list

are expected to be announced Friday. Beijing responded to Trump's

list approval by saying it will impose levies on $50 billion in

U.S. products.

In Europe, bank stocks fared the worst Friday. The Stoxx Europe

600 Bank Index was down 1.3%, heading for its worst session since

June 5. Lenders were under pressure after the ECB on Thursday said

the eurozone's interest rates -- which are at all-time lows -- will

remain at their present levels "at least through the summer of

2019," and that the central bank will closely monitor inflation

developments.

Bank profits are helped by higher interest rates, as that

increases the spread banks earn between longer-term assets, such as

loans, and shorter-term liabilities.

On Friday, Eurostat confirmed its initial estimate of a 1.9%

inflation rate for the eurozone in May year-on-year, meeting

expectations. The ECB targets inflation at just below 2%.

Meanwhile, the euro was modestly higher after it was slammed

down by more than 1.5% in the prior session, hurt by the ECB's

decision to hold off on raising interest rates. After the ECB's

statement Thursday, there was speculation that the central bank

could be shifting toward a rate hike in early to mid-2019, as it

signaled it will wind down its EUR2.5 trillion ($2.95 trillion)

program of bond buying, or quantitative easing.

The move comes after a busy week of central-bank news. On

Wednesday, the Federal Reserve lifted its benchmark federal-funds

rate by a quarter-percentage point and signaled it will raise rates

four times in 2018

(http://www.marketwatch.com/story/fed-hikes-interest-rates-now-sees-4-moves-this-year-2018-06-13).

On Friday, the Bank of Japan left monetary policy steady, but

investors were focused on its comments on consumer price inflation.

The BOJ now sees CPI at a range of 0.5 to 1%, compared with around

1% in its April statement.

What strategists are saying

"With all of this week's central bank event risk out of the way,

we now turn to trade wars," said Elsa Lignos, global head of FX

strategy at RBC Capital Markets.

"This shouldn't come as a surprise, given how well-flagged these

tariffs have been -- but many may have assumed Trump's stance would

soften given the positive reaction to the Kim summit -- and

confirmation that the tariffs are going ahead could still cause

some risk aversion," Lignos said in a note.

"With the ECB sounding cautious on inflation, the market took

this as a dovish steer on future rate moves. ... Essentially, the

ECB is now formally beginning on its tightening path and this

should help to support the euro in the medium to longer term," said

Richard Perry, market analyst at Hantec Markets.

"For now, the euro is under pressure, but once the dust settles

it should begin to find support once more," Perry said in a

note

Stock movers

Among bank stocks, Spanish lender Bankia SA (BKIA.MC) fell 2.1%,

and Italian lender Banco BPM SpA (BAMI.MI) gave up 2.9%. French

bank Societe Generale SA (GLE.FR) lost 1.4% and Germany's Deutsche

Bank AG (DBK.XE) lost a more modest 0.3%.

Indivior PLC shares (INDV.LN) sank 18% after the U.S. Food and

Drug Administration late Thursday said it approved the first

generic version of a Suboxone under-the-tongue film

(http://www.marketwatch.com/story/fda-approves-generic-version-of-suboxone-film-2018-06-14)

used treat opioid addiction. Indivior is the maker of Suboxone.

Rolls-Royce Holdings PLC (RR.LN) rallied 13% after the British

aircraft-engine maker said its planned job cuts should help it

exceed a target of GBP1 billion in cash flow

(http://www.marketwatch.com/story/rolls-royce-job-cuts-to-help-hit-1b-in-cash-flow-2018-06-15)

by 2020. Rolls-Royce on Thursday said it would cut 4,600 jobs over

the next 24 months

(http://www.marketwatch.com/story/rolls-royce-to-cut-4600-jobs-amid-engine-problems-2018-06-14).

BTG PLC shares (BTG.LN) dropped 4.5% after the health care

company said an FDA panel voted against approving its Elevair

Endobronchial Coil System for the treatment of people with severe

emphysema.

(END) Dow Jones Newswires

June 15, 2018 06:12 ET (10:12 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

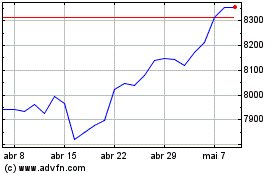

FTSE 100 (FTSE:UKX)

Gráfico Histórico do Índice

De Mar 2024 até Abr 2024

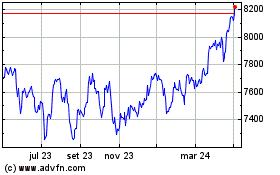

FTSE 100 (FTSE:UKX)

Gráfico Histórico do Índice

De Abr 2023 até Abr 2024