JetBlue to Order 60 Airbus CSeries Jets -- Update

10 Julho 2018 - 9:28PM

Dow Jones News

By Andrew Tangel and Robert Wall

JetBlue Airways Corp. on Tuesday said it would buy 60 CSeries

jetliners from Airbus SE with options for more, as the European

plane maker's rivalry with Boeing Co. extends into the market for

smaller planes.

Airline executives said the new aircraft would expand the reach

of the smaller aircraft in JetBlue's fleet, allowing them to take

transcontinental U.S. flights while burning 40% less fuel per

seat.

The JetBlue Airbus A220-300 planes would also offer wider seats

and more capacity that could include the airline's premium seats,

they said.

"It's truly the next generation of aircraft that customers will

love," JetBlue Chief Financial Officer Steve Priest said in an

interview. He added the new planes would also boost the airline's

profit potential.

JetBlue is already a big Airbus customer. But the New York-based

carrier also had considered upgrading or replacing its fleet of

small jets made by Brazil's Embraer SA rather than purchasing the

rebranded CSeries that Airbus took control of on July 1 in a

partnership with Canada's Bombardier Inc. Mr. Priest said it was a

"very, very difficult decision."

That decision will intensify the rivalry that drove Airbus and

Boeing to seek partnerships with smaller plane makers. Airbus and

Boeing are looking to their respective partners, Bombardier and

Embraer, to yield cost savings by helping pressure suppliers to

offer bigger volume discounts.

The deal could be worth around $5 billion before discounts

standard to such contracts. JetBlue executives declined to say how

much the airline will pay for the airplanes.

Mr. Priest said JetBlue expected to take delivery of the first

five of the new planes in 2020, with the rest coming by 2025 as

Airbus ramps up production. The carrier said it had options for 60

more of the planes.

Boeing said last week that it will take control of Embraer's

jetliner business. The plan requires government approvals and isn't

expected to close until late next year. Until then, Boeing is

barred from marketing Embraer's planes.

A Boeing spokesman declined to comment on JetBlue's purchase

from Airbus.

Bombardier had struggled to win big orders for the

fuel-efficient CSeries outside of a 75-jet deal in 2016 with Delta

Air Lines Inc. Bombardier lacked the sales heft of Airbus and

Boeing to convince airlines to commit to a brand- new plane.

Airbus on Tuesday put its stamp on the program, renaming the

jets the A220-100 for the 100-seater model and A220-300 for the

130-seater. It is dropping the earlier CSeries CS100 and CS300

designations. The JetBlue A220-300 planes will be assembled at

Airbus's U.S. production site in Mobile, Ala., the airline

said.

Airbus Chief Executive Tom Enders last week said the first

results of the CSeries takeover would be visible soon. The

Toulouse, France-based plane maker said it doesn't comment on

discussions with potential customers.

The fortunes for the CSeries began to improve in 2016 when Delta

agreed to buy 75 CSeries planes with options for 50 more. Boeing

challenged the deal with U.S. regulators, accusing the Canadian

rival of unfairly selling the plane below cost. A U.S. trade panel

ruled against the Chicago-based manufacturer.

Bombardier is building an assembly plant in Alabama to build

CSeries jets for the U.S. market.

JetBlue also said it would upgrade 25 orders for Airbus A320neo

single-aisle planes to larger A321neo models. Mr. Priest said the

changes wouldn't pave the way for potential flights to European

destinations, as such routes would require additional upgrades.

Write to Andrew Tangel at Andrew.Tangel@wsj.com and Robert Wall

at robert.wall@wsj.com

(END) Dow Jones Newswires

July 10, 2018 20:13 ET (00:13 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

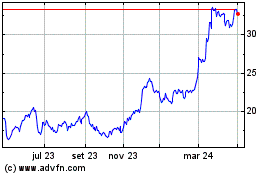

EMBRAER ON (BOV:EMBR3)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

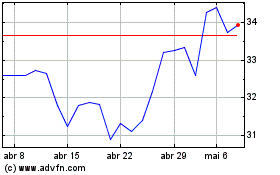

EMBRAER ON (BOV:EMBR3)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024