Global Trade Spat Unnerves Plane Makers

15 Julho 2018 - 5:58PM

Dow Jones News

By Andrew Tangel and Robert Wall

LONDON -- Aerospace executives at plane makers Boeing Co. and

Airbus SE, along with their suppliers, said they are worried new

trade barriers could drive up plane manufacturing costs and lead

airlines to put off purchases.

"Aerospace thrives on global trade -- free and open trade,"

Boeing Chief Executive Dennis Muilenburg said in London on Sunday

ahead of the Farnborough International Airshow, the industry's

flagship gathering that kicks off Monday.

"We're concerned about some of the ongoing talk about tariffs

and trade restrictions," the head of the U.S.'s largest exporter

told reporters, though he added that there had been no material

effect on company so far.

Earlier this month, Tom Enders, chief executive of European

rival Airbus, said protectionist sentiments could dampen global

growth. "There are some clouds on the horizon," he said. "We're on

the brink of a trade war" between the U.S. and China as well as

with Europe, he said.

Worries over shifting trade policies, new tariffs and other

barriers come as plane makers including Boeing, Airbus and Embraer

are looking to tout their latest deals to drum up buzz and new

business.

The Trump administration this year imposed tariffs on a range of

imports from aluminum to washing machines from China, the European

Union and others, saying previous trade deals treated the U.S.

unfairly and threatened domestic jobs.

Airlines are currently in buying mode amid rising world-wide

passenger demand, and airplanes have so far largely avoided being

targeted by tariffs from the U.S. and China The U.S., though, has

taken aim at some airplane parts imported from China. China had

threatened to target finished jetliners, but so far hasn't.

The U.S. clash with China is particularly fraught for Boeing

because it has big business in both countries. Boeing is

forecasting industrywide demand growth over the next two decades:

43,000 commercial planes worth nearly $7 trillion, up from 41,000

forecast for the next two decades last year. Of that, 7,200 planes

should go to China.

In a May 11 letter to the U.S. Trade Representative's office,

Boeing executive Timothy Keating said such tariffs could threaten

Boeing's access to China, which could retaliate by slowing or

refusing imports of Boeing commercial jetliners, opening the door

for rival Airbus.

Mr. Muilenburg on Sunday expressed hope that both U.S. and

Chinese leaders would recognize what he described as the two

countries' symbiotic relationship, crucial to growth and job

creation.

China is expected to become a driver of global demand for

commercial planes in coming years, he said, adding: "They need the

lift, the aerospace capability to help drive the rest of their

economic growth agenda."

Gaël Méheust, chief executive of engine maker CFM International,

a joint venture of General Electric Co. and France's Safran SA,

said, "We're really hoping that this is just politics and this will

not affect, in the long-run, the economy."

Trade is only one of the potential threats to an almost

decadelong period in airline passenger growth, Mr. Méheust said. A

drop in cargo demand, often a leading indicator for air traffic,

rising oil prices and labor cost inflation are "an indication

things may not be as good as we want."

Brazilian airliner maker Embraer SA said it is worried about the

currency effect for the dollar-denominated industry amid the trade

conflict. Chief Executive Paulo César de Souza e Silva said in an

interview that "a much stronger dollar vis-à-vis local currencies

can cause more challenges for the airlines."

Write to Andrew Tangel at Andrew.Tangel@wsj.com and Robert Wall

at robert.wall@wsj.com

(END) Dow Jones Newswires

July 15, 2018 16:43 ET (20:43 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

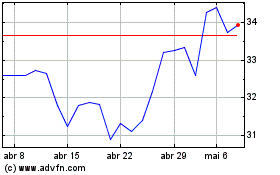

EMBRAER ON (BOV:EMBR3)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

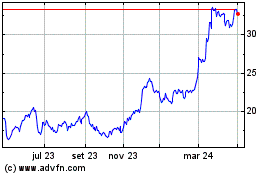

EMBRAER ON (BOV:EMBR3)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024