Credit Suisse Laundering Curbs Hit -- WSJ

18 Setembro 2018 - 4:02AM

Dow Jones News

By Brian Blackstone and Pietro Lombardi

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 18, 2018).

ZURICH -- Credit Suisse Group AG was ordered to bolster its

anti-money-laundering processes by Switzerland's financial

regulator on Monday, but avoided any financial penalties for its

shortfalls.

The regulator, Finma, stopped short of imposing fines on the

Swiss banking giant after uncovering shortfalls over nearly a

decade through 2014 in the bank's dealings with South American oil

companies and Swiss-based FIFA, the world's top governing body for

soccer.

Investors shrugged off the rebuke, with Credit Suisse shares

down just 0.3% in early afternoon trading in Europe.

Finma said in a statement that it "identified deficiencies in

the bank's adherence to anti-money-laundering due diligence

obligations in relation to suspected corruption" involving FIFA,

Brazil's Petróleo Brasileiro SA (PBR) and Venezuela's Petróleos de

Venezuela SA.

Credit Suisse disclosed in 2015 that it had received inquiries

from U.S. and Swiss government authorities regarding its banking

relationships with FIFA-related individuals and entities.

The Swiss watchdog ordered the bank to strengthen its controls

and said it would appoint an independent third party to monitor

implementation. Finma acknowledged "some substantial" improvements

in Credit Suisse's money-laundering controls and its

cooperation.

"We are grateful to Finma for its acknowledgment of the

improvements that have been made to our compliance and control

framework over the last few years and of the additional measures

already planned by the bank," Credit Suisse said in a

statement.

The findings are "part of an ongoing review of legacy cases

across the Swiss banking sector," it added, noting that the cases

originated between 2006 and 2014, which was before the arrival of

Chief Executive Tidjane Thiam. "Finma has not imposed any fine on

Credit Suisse, not ordered any disgorgement of profits nor any

limitation of business activities," the bank said, adding that it

has hired more than 800 compliance specialists in less than three

years.

Still, the Finma report underscores the challenge Swiss banks

face to turn the page from past controversies. In July,

Switzerland's largest bank, UBS Group AG, was censured by the U.S.

Office of the Comptroller of the Currency over "systemic

deficiencies" in its anti-money-laundering systems at branches in

New York, Connecticut and Florida.

The findings from Finma come at a challenging time for Credit

Suisse, which is nearing the end of a three-year strategic overhaul

initiated by Mr. Thiam, who joined the bank in mid-2015. As part of

the overhaul, the bank has turned its focus to managing wealthy

clients' money while maintaining a streamlined investment bank.

Credit Suisse posted annual losses from 2015 to 2017, but is on

track to run a profit this year. Still, its share price is down

about 18% so far this year.

Finma also said it found shortcomings in Credit Suisse's

relations with a "politically exposed person," or PEP.

"Finma established that the bank had failed to adequately

record, contain and monitor the risks arising over a number of

years from the PEP business relationship and the responsible (and

since criminally convicted) client relationship manager," the

watchdog said.

Write to Brian Blackstone at brian.blackstone@wsj.com and Pietro

Lombardi at Pietro.Lombardi@dowjones.com

(END) Dow Jones Newswires

September 18, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

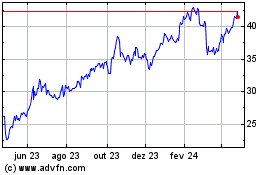

PETROBRAS PN (BOV:PETR4)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

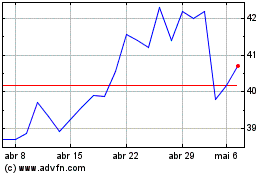

PETROBRAS PN (BOV:PETR4)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024