Imports Surge at U.S. Ports as Companies Brace for New Tariffs

15 Novembro 2018 - 6:08PM

Dow Jones News

By Erica E. Phillips

LOS ANGELES -- Imports into U.S. seaports are surging over usual

seasonal patterns in an apparent push by retailers and

manufacturers to pull orders forward ahead of a new round of

tariffs set to hit U.S.-China trade in January.

Ports in Southern California, Georgia and Virginia reported

double-digit growth in import volume from September to October,

setting monthly records as furniture, apparel, auto parts and other

goods streamed in.

"It's going fast and furious," said Alan McCorkle, senior vice

president with Yusen Terminals LLC, a container-handling operation

at the Port of Los Angeles. "October was just pumping."

The neighboring ports of Los Angeles and Long Beach, the

nation's top hub for container trade and the main destination for

imports from China, handled a combined 849,908 20-foot equivalent

units, or TEUs, of loaded inbound containers last month. That was

up 17.7% from the same month last year and 10.2% from

September.

Mr. McCorkle said Yusen has opened an additional entry gate for

trucks coming to handle the latest wave of imports. Container

stacks on the terminal are "five- or six-boxes high, where normally

it'd be four," he said.

Goods affected by tariffs in particular appear to be moving.

Trade analyst Chris Rogers of the Panjiva research group said

imports of apparel rose 19.7% year-over-year in October. Furniture

imports were up 14.7%, and auto-parts imports rose 9.9% last month

compared with a year ago.

The surge follows a slight lull in Southern California during

the normally busy months of July and August, after an earlier round

of tariffs kicked in. But port officials and logistics companies

said they expected another rush before the end of the year, with a

new round of tariffs slated to go into effect Jan. 1.

October's import activity proved them right.

On the East Coast, container ports in Norfolk, Va., and

Savannah, Ga., reported swells in October imports. The Port of

Virginia said loaded imports rose 17% to 127,677 TEUs from

September to October. In Georgia, import cargo was up 18.5%

month-to-month, reaching 205,836 TEUs.

Additional ocean vessels have been added to trans-Pacific

routes, and some ocean shipping companies are sending larger ships,

analysts with Citigroup Global Markets Inc. wrote in a research

note last week. Citi added that companies including Costco

Wholesale Corp., Floor & Décor Holdings Inc., Lumber

Liquidators Holdings Inc., and Eaton Corp. PLC have said they

planned to pull forward their import volumes to get ahead of

tariffs.

Advancing orders early carries direct and potentially indirect

costs for retailers and manufacturers. Companies will have to hold

inventories longer, and the longer lead times mean retailers could

be stuck with extra products that don't sell.

Executives at Walmart Inc. said on a recent call with reporters

they are reviewing every item expected to be subject to

tariff-related increases in the coming months, and discussing with

suppliers ways to reduce costs.

Meanwhile, shipping companies are bracing for a potential

drop-off in demand once the calendar flips.

A.P. Moeller-Maersk AS Chief Executive Soren Skou said the

U.S.-China trade dispute has boosted the flow of goods on the

company's ships, but he expects demand to decline early in 2019

after more tariffs are expected to go into effect. If the U.S. and

China resolve their differences, he said, companies could start

destocking, or selling off existing inventories, while scaling back

new orders.

Write to Erica E. Phillips at erica.phillips@wsj.com

(END) Dow Jones Newswires

November 15, 2018 14:53 ET (19:53 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

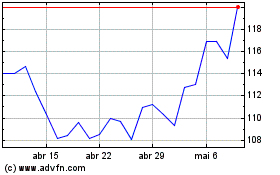

Floor and Decor (NYSE:FND)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

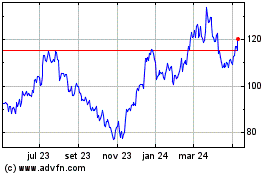

Floor and Decor (NYSE:FND)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024