Walmart's Multibillion-Dollar U.K. Merger Faces Huge Hurdle -- Update

20 Fevereiro 2019 - 8:21AM

Dow Jones News

By Ian Walker

British regulators said they were leaning toward blocking a

proposed merger between Walmart Inc.'s British grocery unit and

rival J Sainsbury PLC, threatening to scuttle one of the retail

giant's biggest overseas overhauls.

Last April, Walmart agreed to merge British arm Asda Group into

Sainsbury in a deal that valued the U.K. business at about GBP7.3

billion ($9.5 billion). Walmart agreed to keep a 42% stake in the

combined company, which would become Britain's largest grocery

chain.

The move was part of a broader shift by Walmart to form joint

ventures in competitive overseas markets. Asda has been one of

Walmart's most profitable foreign forays since it bought the chain

in 1999. Growth has slowed more recently amid intense competition

in the U.K., both from traditional players like Tesco PLC, online

players -- including Amazon.com Inc., which owns Whole Food outlets

in the U.K. -- and discounters like German chains Aldi and

Lidl.

Regulatory hurdles always posed a threat to the deal. The U.K.

grocery market is already highly consolidated, with the top four

players commanding over 60%. A combined Asda-Sainbury would operate

2,800 stores and command a 27% market share, according to Kantar.

It made about GBP51 billion in revenue in 2017.

On Wednesday, the Competition and Markets Authority said it has

provisionally found that the deal, in its current form, could push

up prices and reduce quality. It also said the merger could lead to

a rise in prices at a large number of Sainsbury and Asda gas

stations across Britain.

The regulator didn't specifically block the deal, but said that

was one of the options it was considering. It said it could also

force the companies to sell a significant number of stores or other

assets. But the CMA said it didn't believe divestitures alone would

address its concerns. It expects to announce a final report by the

end of April.

Sainsbury shares were 15% lower Wednesday. Other U.K. grocery

stocks also fell.

In a joint statement, Sainsbury and Asda said they fundamentally

disagree with the provisional findings, citing a misunderstanding

by the regulator of shopping habits in the U.K. They said the "CMA

has moved the goalposts, and its analysis is inconsistent with

comparable cases."

Last week, the CMA extended the timetable of its inquiry into

the proposed merger due to the case's scope and complexity.

The setback comes as Walmart is rejiggering its overseas

operations. Last year, it sold its controlling stake in its

Brazilian operations and bought a majority stake in Flipkart Group,

India's largest e-commerce company, for $16 billion.

Walmart has struggled with fierce competition in the U.S., where

rival Amazon has broadened its branded food and own-label offerings

while improving delivery options. Earlier this week, Walmart

reported strong holiday sales, attributing part of that to its

success attracting online shoppers.

Walmart has options if the deal is blocked, analysts said. James

Grzinic at Jefferies said he expects a sale to happen either way.

He said a private equity bid for Asda could be a possible option.

"An alternative offer with no obvious regulatory concerns is likely

to emerge quickly," he said.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

February 20, 2019 06:06 ET (11:06 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

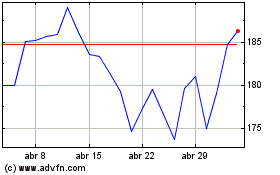

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024