Amazon's Ad Business May Be Growing Faster Than Thought

20 Fevereiro 2019 - 8:29AM

Dow Jones News

By Alexandra Bruell

Amazon.com Inc.'s ad business is again outstripping earlier

projections.

Last September, the research firm eMarketer said Amazon would

finish 2018 as the third-largest digital ad seller in the U.S.,

with a larger market share than eMarketer expected just six months

earlier, partly due to accounting changes by the e-commerce

giant.

EMarketer has again revised upward its estimates for Amazon's

U.S. ad revenue for both past and future years. This time the boost

is due partly to third-party data indicating that advertising

provides more of Amazon's revenue than was thought, said Monica

Peart, senior forecasting director at eMarketer.

EMarketer now estimates that Amazon's ad revenue in 2017 totaled

$3.3 billion, for example, up from its estimate of $1.9 billion in

September.

Amazon generates advertising revenue from various business

units, including its e-commerce site, the live-streaming

video-gaming site Twitch, film site IMDb and its advertising

technology division.

Amazon's ad revenue is expected to increase to $15 billion in

2020, or just under 10% of the digital ad market share in the U.S.,

from $11.3 billion in 2019 and an 8.8% share, according to the

latest forecast.

Alphabet Inc.'s Google and Facebook Inc. will continue to

dominate the digital ad pie, with a combined $89 billion in ad

revenue in the U.S. in 2020, according to eMarketer's predictions.

But Amazon's accelerating rise is giving marketers hope of an

alternative to the so-called digital duopoly, although some fear

Amazon's growing power.

EMarketer increased its estimate for Facebook's U.S. ad revenue

for 2019 by about $1 billion, due to strong growth from Instagram

as advertisers increase investments in the platform, said Ms.

Peart.

Reports are more consistent for Google and Facebook, where

advertising accounts for the bulk of revenue and both companies

report their advertising revenues directly. Amazon reports a

revenue category that includes advertising, but not the advertising

dollars themselves.

As marketers allocate more dollars to digital video and social

platforms to reach consumers, digital ad spending is usurping

traditional ad spending in mediums like television, radio, print

and outdoor, Ms. Peart said.

Digital ad spending in the U.S. is expected to grow 19% to

$129.3 billion this year, according to eMarketer, accounting for

54.2% of total U.S. ad spending and surpassing traditional ad

spending for the first time.

Write to Alexandra Bruell at alexandra.bruell@wsj.com

(END) Dow Jones Newswires

February 20, 2019 06:14 ET (11:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

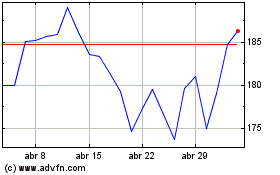

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Amazon.com (NASDAQ:AMZN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024