UnitedHealth to Require Drug Rebates Go to Consumers

12 Março 2019 - 7:29AM

Dow Jones News

By Anna Wilde Mathews

UnitedHealth Group Inc. said it would significantly expand a

change to how it handles rebates from drugmakers by requiring new

employer clients to pass them on to people who take the

medications.

The move will apply to employers that sign new contracts after

Jan. 1, 2020, but UnitedHealth will grandfather in existing clients

that chose a different setup. The new shift will involve employers

that begin using UnitedHealth's pharmacy-benefit manager, OptumRx,

including those that are self-insured, which is the vast majority

of large companies.

Drugmakers routinely pay rebates to insurers and

pharmacy-benefit managers to offset the full list price of

brand-name drugs. The companies use the rebates in a variety of

ways. Often, they are passed along to employer clients, which may

use them to reduce premiums for all workers, or defray their own

costs.

The move goes further than other major pharmacy-benefit

managers, which haven't made it mandatory to pass rebates on to

consumers, according to UnitedHealth and industry consultants. The

Trump administration has proposed a parallel approach that would

affect Medicare and Medicaid plans, which pharmacy-benefit managers

have generally opposed.

"We're focused on making sure the value we're negotiating on

behalf of our clients is passed on to the consumer," said John

Prince, chief executive of OptumRx. The move to make the shift

mandatory for new clients "is a huge statement to the market," he

said. UnitedHealth officials say the employer-plan situation is

different from Medicare, where shifting the rebate treatment could

force up premiums significantly.

UnitedHealth this year switched to passing along rebates

directly to consumers under certain employer plans offered by its

insurance arm, UnitedHealthcare, now affecting about nine million

people.

The topic of rebates--along with the opaque process of setting

prices for drugs in general--is currently under a bright spotlight,

with pharmaceutical executives in a recent congressional hearing

blaming the practices of insurers and pharmacy-benefit managers for

driving prices higher.

On the other side, health plans and benefit managers have said

they rein in costs by negotiating with drugmakers, including by

winning rebates that could be used to reduce premiums.

But critics, including Trump administration officials, say the

rebates should flow directly to the consumers who take the affected

medications to reduce their out-of-pocket charges. UnitedHealth

said its existing program to pass through rebates has lowered costs

for affected consumers by $130 per prescription on average and

increased their adherence to medication regimens.

A growing share of large employers pass along rebates to

patients who take the affected drugs, according to a survey by the

National Business Group on Health. Of the large employers surveyed,

20% were doing it in 2018, another 7% said they planned to start

this year and an additional 31% were considering a shift in 2020 or

2021. Brian Marcotte, CEO of the employer group, said he believed

the shift to passing rebates along to consumers "is the direction

everything is going."

Still, UnitedHealth risks pushback from employers that want to

use rebates in other ways. "Some employers won't like it,

absolutely," said Nadina Rosier, who is head of the pharmacy

practice at advisory firm Willis Towers Watson. "They want

flexibility to manage the benefit in the way they see fit, and the

goal is to drive to lowest net cost."

David Dross, leader of the pharmacy practice at Mercer, a

consulting unit of Marsh & McLennan, said some employers might

want the freedom to handle rebates the way they want and "they

might base their decision about a PBM on that."

Daniel J. Schumacher, president of UnitedHealthcare, said there

is a "potential risk" in making the rebate approach mandatory, but

"we think it's a risk worth taking," with major benefits

particularly for consumers who take high-cost medications.

Write to Anna Wilde Mathews at anna.mathews@wsj.com

(END) Dow Jones Newswires

March 12, 2019 06:14 ET (10:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

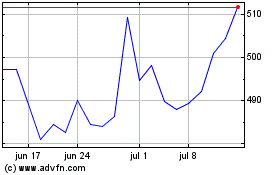

UnitedHealth (NYSE:UNH)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

UnitedHealth (NYSE:UNH)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024