By Peg Brickley

The judge presiding over the bankruptcy of PG&E Corp. is

worried that another year of wildfires could upend the utility's

efforts to pull out of massive financial and legal trouble.

Judge Dennis Montali cited the possibility that blazes this

year, with PG&E under chapter 11 protection, could tip the

utility into default on the $5.5 billion bankruptcy loan he has

been asked to approve.

"There's an elephant in the room here. We all know there could

be 2019 wildfires," Judge Montali said at a hearing in U.S.

Bankruptcy Court in San Francisco where PG&E and its lenders

are seeking approval of the loan.

Led by JPMorgan Chase & Co., lenders have offered

concessions, but approval of the loan has been held in limbo while

wildfire claimants examine the revised financing deal. If an

official committee representing people with damages from the fires

agrees to drop its objections, the loan will be approved. If the

committee rejects the compromise deal, Judge Montali said, he will

decide whether to approve the loan over its objection.

California's largest utility, PG&E filed for chapter 11

bankruptcy protection at the end of January, launching an effort to

resolve an estimated $30 billion worth of damage claims from

earlier fires. If the fires return this year, the damages would be

top-priority debts, because PG&E, in bankruptcy, must pay all

its current bills.

"There could be an astronomical claim," the judge said. A big

2019 wildfire damage claim could give lenders power over the

affairs of a utility that supplies power to millions of

Californians, due to provisions that govern remedies for

defaults.

The prospect that this year could see a continuation of the

deadly blazes has haunted the utility. Wildfires in 2015, 2017 and

2018 triggered the bankruptcy. Fires this year could be big enough

to tip the bankruptcy loan into default, with uncertain

consequences for PG&E and its efforts to stabilize, Judge

Montali said.

The company and its lenders have pushed for approval of the

financing and said the default provisions are standard for loans to

problem companies. Judge Montali pushed back, concerned that the

risk of default is real, and lender remedies could be too

strong.

Lawyers for people with wildfire-damage claims have said the

bankruptcy loan gives lenders too much control over PG&E's

future, especially if something goes wrong.

Judge Montali, a bankruptcy judge, cited a second high-level

risk to PG&E's case: Judge William Alsup, the federal judge is

overseeing the company's criminal probation safety violations. A

U.S. district court judge appointed under Article III of the U.S.

Constitution, Judge Alsup has been critical of PG&E's safety

record. He has the power to take PG&E's chapter 11 case away

from the bankruptcy judge, oust management and put the company in

the hands of a trustee.

Under terms of the bankruptcy loan, appointment of a trustee is

a default.

"We have an Article III judge that feels very strongly about

what this utility is up to," Judge Montali said. "What if he

decides, 'I don't like management, I am going to order the

appointment of a trustee, instantly'?"

In early April Judge Alsup is scheduled to review PG&E's

conditions of probation on a felony conviction for safety lapses.

Earlier this year, he found the company has violated its

probation.

In an effort to win support from the official committee of

wildfire victims and get approval from the judge, lenders agreed to

give PG&E more time to refinance the bankruptcy loan, if a

default is declared.

Bankruptcy lending is big business. and PG&E's loan is one

of the largest ever made. The bankruptcy financing is being made to

an essential utility that has a large cushion of unencumbered

collateral -- at least $70 billion. That cushion means the risks

for lenders are relatively low, and opportunities for Wall Street

investors to trade are great.

"People are going to be making money left and right," said

Cecily Dumas, lawyer from an official committee of wildfire

victims, in court Wednesday.

She urged PG&E to allot funding to the northern California

city of Paradise, which was destroyed in the 2018 fires.

"Even the capital markets would appreciate the debtor making the

gesture of housing and sheltering these people," she said.

The company has said it is going to provide a housing fund for

wildfire victims but has not disclosed details about when and how

much money will be set aside.

PG&E filed for chapter 11 protection not long after agreeing

to settlements with victims of the 2015 fire. Those people may have

to wait years, and collect reduced settlements, because of the

bankruptcy. The amount at stake in the settlements is about $15

million, which is a small fraction of the bankruptcy loan,

according to Christopher Hawkins, lawyer for some of the

claimants.

"Help them get on with rebuilding their lives," Mr. Hawkins

urged.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

March 13, 2019 17:58 ET (21:58 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

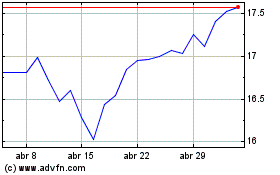

PG&E (NYSE:PCG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

PG&E (NYSE:PCG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024