By Julie Wernau and Julie Jargon

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 14, 2019).

Starbucks Corp. built its empire in China on the idea that

consumers there would want to be seen inside its posh cafes.

Now the Seattle-based company is struggling to keep up as local

upstart Luckin Coffee wins over a new kind of Chinese customer --

one who wants their caffeine jolt delivered in minutes. The

company's sudden rise has put Starbucks, Luckin and McDonald's

Corp. in a race to build the delivery system best tuned to the

frenetic Chinese market.

In Beijing's Wudaokou neighborhood, 24-year-old manicurist Luo

Fei started ordering from Luckin earlier this year. One week last

month she had a hazelnut latte delivered from Luckin every day. She

was impressed that each arrived in under 20 minutes.

"It's pretty fast every time," Ms. Luo said.

The battle to bring on-demand coffee to China shows how

important delivery has become for Western companies doing business

in the country, as well as how quickly competitors can emerge in

the world's second-biggest economy.

Consumers in the densely packed cities of the world's most

populous nation have grown accustomed to ordering meals and

consumer goods for rapid delivery. In some cities, so many orders

arrive simultaneously that office and apartment buildings have

installed robots to receive deliveries and avoid crowding

elevators.

During its two decades operating in China, Starbucks has focused

on the country's wealthiest consumers, building thousands of

well-appointed stores where customers can linger over expensive

drinks. Delivery was a recent addition. Unofficial outfits had been

delivering Starbucks coffee previously, but in August 2018

Starbucks teamed up with Ele.me, the food-delivery platform owned

by Alibaba Group Holding Ltd., to offer delivery from an initial

150 stores starting in September.

By then, the coffee giant had spent nearly two years developing

special lids and packaging to protect drinks from spilling or

cooling during the mad dash to customers in China.

Luckin, backed by venture capital and run by local managers,

integrated delivery into the service at its bare-bones stores from

the outset. Since its founding in October 2017, Luckin has raised

$1 billion and opened 2,000 stores mainly offering delivery or

pickup -- many just feet away from a Starbucks cafe, according to

financial analytics company Thinknum.

"We know that Starbucks have done their homework," said Reinout

Schakel, Luckin's chief strategy and financial officer. "We know

they sit in locations where there's a lot of demand."

Luckin is currently in talks to get a loan of around $200

million from a few Wall Street banks, said a person familiar with

the matter. The company is also preparing for an initial public

offering in New York that could happen as soon as the first half of

this year, the person said, adding that the company will target a

valuation of $3 billion.

Starbucks Chief Executive Kevin Johnson has touted the coffee

giant's expanding opportunities in China -- its largest market

outside the U.S. -- while acknowledging the challenges of

navigating an evolving landscape and shifting consumer behaviors.

"We expect competition to remain highly promotional and

disruptive," he told investors in January.

Starbucks and Luckin guarantee delivery within a half-hour in

major Chinese cities. McDonald's, which launched coffee delivery in

Shanghai last year, guarantees orders will arrive within 28 minutes

from a more limited number of its restaurants.

Starbucks plans to open nearly 600 stores in China this year on

top of the 3,700 it operates there now. Luckin plans to open about

2,500 stores in China this year, which would bring its total to

4,500. Both companies hope delivery will entice consumers to crave

coffee more often and make more profitable purchases at physical

stores.

It is a big bet, considering China is still developing a taste

for coffee. Annual coffee consumption per capita is roughly 5 to 6

cups in China, compared with the more than 300 cups per capita

consumed by Americans annually, according to Sanford C. Bernstein

researchers.

And like food delivery in the U.S., analysts say, sending coffee

to customers in China is mostly a money-losing endeavor.

Starbucks and Luckin wouldn't say how much it costs to deliver

their coffee or how much they have invested in those services. But

Starbucks charges a lot more for its coffee than Luckin, which has

appealed to cost-conscious consumers as China's economic growth has

slowed.

In Beijing, a 16-ounce Americano costs 37 yuan ($5.52) to have

delivered from Starbucks and 27 yuan ($4.02) from Luckin. Starbucks

orders include an added charge of 9 yuan ($1.34) for Ele.me, whose

drivers fill the orders. Luckin's orders include a 6 yuan ($0.89)

fee for its courier partner, SF Express.

Delivery companies charge Starbucks and Luckin an average of 7

yuan ($1.04) per order, according to David Dai, senior analyst at

Sanford C. Bernstein in Hong Kong.

Starbucks surprised investors last year when same-store sales in

China fell 2% in its fiscal third quarter ended in July, partly

because of tough competition for deliveries. Sales improved in the

past two quarters, but growth is considerably slower than before

Luckin began expanding.

Starbucks expects its profit margin in China this year to be

hurt by costs associated with delivery. It is making a big push on

the service, aiming to offer it at about 90% of Starbucks stores in

the country by September. The company derived approximately $2.5

billion in fiscal 2018 revenue from China, or 10% of overall

revenues, Sanford C. Bernstein estimated.

Luckin is a privately held company and hasn't released sales

figures.

Getting coffee from shop to consumer is no small feat in a city

like Beijing, where coffee is delivered by scooter. Delivery

drivers face oppressive traffic and jostle one another in building

lobbies as they hustle toward customers.

Each Starbucks delivery order requires sealing a drink with the

special spill-proof lid and delivery bags that show a customer

their order hasn't been tampered with. A caramel macchiato served

in stores with a drizzle of caramel syrup on top is delivered with

a more durable caramel-flavored foam instead.

Dong Leng, 25, said she splurges on a cappuccino at a Beijing

Starbucks in the morning because she likes the sound the machine

makes and the warmth of the cup in her hands.

In the afternoon, she gets a cheaper pick-me-up delivered from

Luckin. "Luckin is much less expensive than Starbucks," she

said.

--Xiao Xiao, Chunying Zhang, Bingyan Wang and Julie Steinberg

contributed to this article.

Write to Julie Wernau at Julie.Wernau@wsj.com and Julie Jargon

at julie.jargon@wsj.com

(END) Dow Jones Newswires

March 14, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

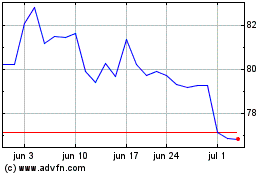

Starbucks (NASDAQ:SBUX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Starbucks (NASDAQ:SBUX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024