Wildfire Victims Continue Challenge to PG&E Bankruptcy Financing

26 Março 2019 - 5:17PM

Dow Jones News

By Peg Brickley

PG&E Corp. has failed to persuade victims of wildfires

sparked by its equipment to go along with a $5.5 billion loan,

terms of which allow Wall Street banks to start dismantling the

company if things go seriously wrong in bankruptcy court.

Lenders had offered concessions that would give PG&E more

time to refinance the loan in the event of a default. However,

papers filed Monday in a San Francisco bankruptcy court say the

official committee that represents people who lost loved ones or

homes in fires occurring over a span of years isn't satisfied with

the concessions.

That means Judge Dennis Montali will have to decide at a court

hearing Wednesday whether to approve PG&E's bankruptcy loan,

one of the largest in history, over the objections of wildfire

victims.

A PG&E spokesman wasn't immediately able to comment on the

continued resistance to the chapter 11 financing by the official

wildfire victims committee.

The California utility filed for chapter 11 protection at the

end of January, planning to stay in bankruptcy for years to tackle

an estimated $30 billion in fire-related liabilities.

Terms of the loan say it could balloon to $9.5 billion if

PG&E's bankruptcy stay is prolonged.

What is worrying wildfire victims, however, are provisions of

the loan that say what happens if PG&E defaults on the

financing and the lenders want to seize assets. Events of default

could include another big wildfire, or a move by Judge William

Alsup, a U.S. District Judge who has been openly critical of

PG&E's safety record. Judge Alsup oversees PG&E's

compliance with terms of its probation for a felony criminal

conviction related to a natural-gas pipeline explosion.

A number of Wall Street firms flocked to get a piece of the

PG&E loan, which is backed by about $70 billion in unencumbered

assets, owned by a borrower with an assured stream of revenue from

millions of Californians that count on it for electricity. Lenders

leading the financing include J.P. Morgan Securities LLC; Merrill

Lynch, Pierce, Fenner & Smith Inc.; Barclays Bank PLC; Citibank

N.A.; BNP Paribas Securities Corp.; Credit Suisse Loan Funding LLC;

Goldman Sachs Bank USA; MUFG Union Bank N.A.; and Wells Fargo

Securities LLC.

PG&E is too big to be allowed to fail, and lenders know the

financing is a sure thing, Cecily Dumas, lawyer for the wildfire

victims committee, said at a hearing on the loan earlier this

month. "There is not a reasonable circumstance in which one can

conceive that this money is at risk," she said.

Lenders insisted on standard loan safeguards, such as a clause

that allows them to declare the loan in default if PG&E suffers

a material adverse change in its circumstances. The so-called MAC

clause would kick in if another wildfire linked to PG&E

equipment racks up damages during the bankruptcy proceeding, for

example.

Another clause says the loan will default if a trustee is

appointed. That could happen if either the bankruptcy judge or

Judge Alsup, presiding over the federal criminal case, decide

PG&E's management can't be trusted.

At an earlier hearing, PG&E's lawyers said there are

safeguards in the loan that would prevent lenders from simply

marching in and seizing pieces of the company. The bankruptcy judge

and the California Public Utilities Commission each have to weigh

in.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

March 26, 2019 16:02 ET (20:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

PG&E (NYSE:PCG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

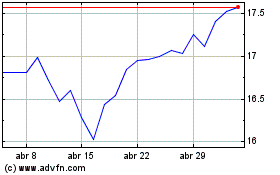

PG&E (NYSE:PCG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024