U.S. Stocks End Higher

26 Março 2019 - 5:49PM

Dow Jones News

By David Hodari and Corrie Driebusch

U.S. stocks rose Tuesday, marking a bounceback from sharp losses

late last week.

After rising as much as 279 points in morning trading, lifted by

energy and bank stocks, the Dow Jones Industrial Average ended the

day up 140.90 points, or 0.6%, to 25657.73. It remains 0.9% below

its level a week prior.

"The moves last week caught us off-guard in terms of the

market's newfound sensitivity to the global economic slowdown

theme," said John Brady, managing director at futures brokerage

R.J. O'Brien & Associates. He said he remains cautiously

confident in U.S. stocks, however.

"The United States is not an island; it will slow as the global

economy slows. But I think we have a buffer," he said.

The S&P 500 ended the day up 20.10, or 0.7%, at 2818.46,

while the Nasdaq Composite added 53.98, or 0.7%, to 7691.52.

Banking stocks outperformed the broader market after taking a

beating late last week, with Goldman Sachs rising $2.18, or 1.2%,

to $190.69 and JPMorgan Chase up 99 cents, or 1%, to 99.92.

Goldman's collaboration with Apple on its new credit card adds to

the recent pressure on financial-sector stocks amid ebbing market

expectations of aggressive monetary policy from central banks.

Shares in energy companies helped lift the Dow industrials

higher, as oil prices continued to rise following a difficult end

to 2018. U.S. crude-oil futures rose 1.9% to $59.94 a barrel in

recent trading, putting its year-to-date gains at 32%.

Investors' and strategists' recent jitters over the prospects

for global growth relating to a raft of downbeat economic data have

prompted a softening in central-bank rhetoric in recent weeks, a

move that has stung bank stocks.

The yield on 10-year U.S. Treasurys was little changed at

2.418%. A recent slip in 10-year U.S. Treasury yields below the

level of three-month Treasury bills has been seen by some investors

as foreshadowing a potential U.S. economic downturn.

With 2019's first financial quarter ending later this week,

investors are looking ahead to the next three months.

"It's been a good quarter for equities, fixed income and credit,

which really raises the bar to repeat that kind of performance in

the second quarter and brings us back to the point that equities

and fixed-income rallying does not, in principle, make sense if the

global economy is slowing," said Kenneth Broux, senior strategist

at Société Générale.

French gross-domestic-product figures on Tuesday matched market

expectations. Growth figures from the U.S. are due Thursday, and

from the U.K., Spain and Canada on Friday. Some strategists

remained optimistic that the gloomy figures of the first months of

the year will prove temporary.

"When you drill down into core inflation, you're seeing robust

demand, robust wage growth, healthy unemployment data and generally

underlying growth remains pretty healthy," said Benjamin Jones,

senior multiasset strategist at State Street.

In Germany, the yield on 10-year government bonds shrugged off a

weaker-than-expected consumer-confidence survey released Tuesday.

That weak survey reading chimed with similarly downbeat eurozone

purchasing managers index figures at the end of last week.

U.K. assets remained little changed despite lawmakers' decision

late Monday to wrest control of the Brexit process away from Prime

Minister Theresa May.

The gains in Europe followed more mixed trading in Asia. Japan's

Nikkei Stock Average climbed 2.2% thanks to buoyant pharmaceuticals

and transportation stocks, while mainland China stocks fell ahead

of the resumption of cabinet-level trade negotiations between the

U.S. and China.

Write to David Hodari at David.Hodari@dowjones.com and Corrie

Driebusch at corrie.driebusch@wsj.com

(END) Dow Jones Newswires

March 26, 2019 16:34 ET (20:34 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

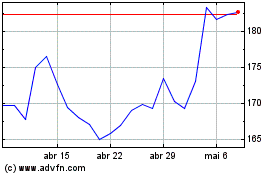

Apple (NASDAQ:AAPL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

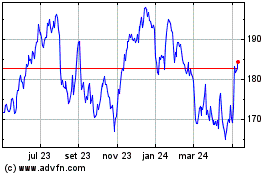

Apple (NASDAQ:AAPL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024