Overheard -- WSJ

17 Abril 2019 - 4:02AM

Dow Jones News

By Charley Grant

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 17, 2019).

Talk about a tough crowd.

Health-insurance giant UnitedHealth Group, one of the star

performers of the stock market until this year, had its usual round

of good news for investors in its first-quarter earnings results.

Adjusted net earnings of $3.73 a share grew by 23% from a year

earlier and topped analyst estimates, and the company increased its

full-year profit forecast.

Investors, however, reacted as though they got a surprise

medical bill. Shares closed down 4% on Tuesday. That was the worst

earnings-related reaction since a brief selloff in 2015, according

to FactSet. But that selloff was in reaction to disappointing

guidance, not to a clean report.

UnitedHealth shares are down nearly 10% so far in 2019, after a

decade of nearly uninterrupted gains.

Investors can successfully predict future earnings and cash

flows, but there is no predicting the mood of Mr. Market.

Write to Charley Grant at charles.grant@wsj.com

(END) Dow Jones Newswires

April 17, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

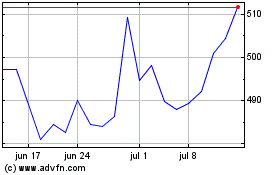

UnitedHealth (NYSE:UNH)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

UnitedHealth (NYSE:UNH)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024