Higher Member Spending Bolsters AmEx -- WSJ

19 Abril 2019 - 4:02AM

Dow Jones News

By Kimberly Chin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 19, 2019).

Higher card-member spending and borrowing helped boost revenue

at American Express Co., despite higher expenses from its rewards

program and loans.

Revenue, net of interest expense, rose 6.6% to $10.36 billion in

the first quarter. Analysts surveyed by Refinitiv expected $10.44

billion in revenue for the quarter.

Discount revenue, which reflects the fees charged to merchants

for accepting AmEx cards, brought in $6.19 billion for the quarter,

a 5.2% increase from a year ago. Analysts expected $6.3 billion

from discount fees.

Card-members rewards, the company's largest single expense that

includes such things as points redeemed for hotels and airfare,

rose 4% to $2.45 billion.

Though card-member loans also grew by 5% for the quarter, the

company generated $2.73 billion from interest on loans, up 17% from

the year prior. AmEx has been promoting lending to its card-member

base in recent years to help boost revenue following the loss of

card partnerships, including that with Costco Wholesale Corp. AmEx

executives have said they are courting more creditworthy consumers

who tend to carry balances on their credit cards rather than pay

their bills in full each month.

Partnerships have been key to driving more customers to its

network. In the last quarter, AmEx had extended its partnership

with Delta Air Lines Inc., its largest cobranded partnership. The

company has said the Delta partnership has brought in more than 1

million new accounts over the past two years and has generated

significant revenue and earnings to both companies.

AmEx, which has been building its reserves for possible losses,

said it had $809 million provision for losses in the quarter, a 4%

increase from a year earlier.

Higher operating expenses also drove profit lower in the first

quarter from a year earlier. AmEx reported net income in the first

quarter was $1.55 billion, or $1.80 a share, down from $1.63

billion, or $1.86 a share, a year earlier. Analysts surveyed by

Refinitiv had projected earnings of $2 a share.

Shares of AmEx fell 0.8% to $110.82 in premarket trading.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

April 19, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

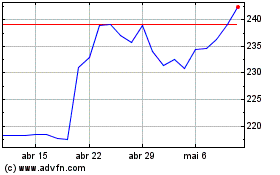

American Express (NYSE:AXP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

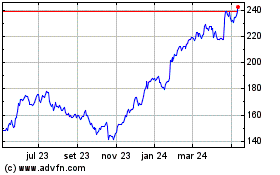

American Express (NYSE:AXP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024