By AnnaMaria Andriotis

Credit-card pitches are moving from the mailbox to the

social-media feed.

Several big card issuers recently increased spending on Facebook

ads in an effort to attract new borrowers.

Capital One Financial Corp. and American Express Co. spent an

estimated $18.6 million and $13.5 million, respectively, on

Facebook ads meant to sign up new consumer-credit-card holders in

2018, according to Mintel Comperemedia's analysis of data from

digital marketing intelligence firm Pathmatics, up from $2.8

million and $4 million in 2017.

Capital One, the fifth-largest U.S. credit-card issuer, has been

paying Instagram and Twitter users with 100,000 to one million

followers to post photos, mostly of restaurant settings, alongside

the bank's Savor rewards credit card, according to Mintel.

Discover Financial Services spent over $1 million on

consumer-credit-card ads aimed at prospective new borrowers on

Facebook in 2018, up from $426,000 a year earlier, according to

Mintel and Pathmatics.

Last year marked the first 12 months of significant spending on

consumer-credit-card acquisition ads on Facebook by card issuers.

While growing, the ad money is still significantly smaller than

what several issuers spend on traditional mail pitches. Capital One

and Discover spent $377 million and $196 million, respectively, on

mailed pitches in 2018, according to Mintel.

Credit-card issuance has slowed since 2017 after years of

healthy growth, and rewards programs have created some challenges.

While big banks calculated that attractive rewards would make

people spend more, some customers have figured out how to game the

system. They spend enough to earn generous sign-up bonuses and

other perks before repeating the process with a new card.

That means banks need to issue more credit cards to replace the

ones that are no longer being used. But traditional modes of

solicitation, including mailings that the banks have relied on for

decades, aren't bringing in enough new card customers.

Direct mail, phone calls and in-branch pitches, which accounted

for an estimated 57% of credit-card sign-ups in 2016, fell to 48%

in 2018, according to Mercator Advisory Group Inc. Banks mailed 3.7

billion credit-card solicitations in 2018, down from 4.5 billion in

2016, according to Mintel.

Still, with so many offers flooding prospective customers,

issuers have struggled to generate interest in new credit cards

through direct mail.

"Nobody is opening the mail," said Brian Riley, director of

credit advisory service at Mercator.

Even those who do open the offers rarely take the next step:

Less than 1% of credit-card solicitations mailed to consumers lead

to an application, according to Mintel.

Card issuers are trying to recruit younger consumers with the

lure of points and other perks, hoping to tap a new class of

customers who don't already carry multiple cards. A priority for

issuers is signing up young adults who spend a lot on travel,

dining and other hobbies.

Several large issuers, including AmEx and Wells Fargo & Co.,

are paying for so-called influencers to post on Instagram and

Twitter. They are typically made up of travel and lifestyle

bloggers with anywhere from 10,000 to one million followers.

In March, photographer Karen Lao, who has more than 89,000

Instagram followers, posted: "When we were in Austin, I used my

@wellsfargo Propel Card for EVERYTHING! Restaurants, gas stations,

hotels and more restaurants...All those categories earn 3X points!

It was so easy to earn points just by living life the way that we

do! #LifeWithPropel #ad."

Digital solicitations, including social-media ads, are the only

type of card pitches that are expected to increase going forward,

according to Mercator. Some 52% of credit-card acquisitions in the

U.S. occurred online in 2018, according to Mercator's estimates, up

from 43% in 2016. That is expected to rise to 56% next year.

Analysts are split on the effectiveness of targeted social

pitches because they generally don't take into account credit

scores. Yet tapping into consumers' interests is a potential "gold

mine" for the issuers, said Sarah Prohm, managing director of

financial services at Competiscan, which tracks credit-card

solicitations.

When Capital One rolled out a new Savor credit card in August,

with 4% cash back on dining, among other perks, the bank went to

Facebook to spread the message. According to Mintel's analysis of

Pathmatics data, Capital One paid for Savor ads to be displayed

there more than one billion times from August through March.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

April 23, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

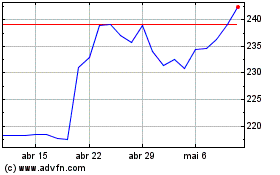

American Express (NYSE:AXP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

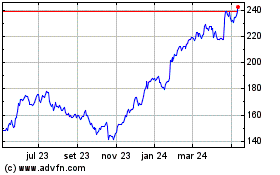

American Express (NYSE:AXP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024