By Gretchen Morgenson

An effort by former Verizon Communications Inc. employees to

push for governance changes at the wireless carrier will face

another test this week, highlighting the retirees' reputation as

unlikely corporate activists.

Since 1998, the Association of BellTel Retirees, a group of

former Verizon employees and current shareholders, has used the

proxy voting process to effect 11 major changes in the company's

corporate-governance practices. These have included trimming the

use of so-called golden parachutes for executives, allowing holders

to nominate directors and putting pay practices to an annual

investor vote.

Now, Verizon shareholders will vote at the company's annual

meeting this Thursday on a group proposal that the retirees hope

will persuade Verizon to stop offering executives an investment

option in their company-sponsored savings plans that generates

above-market returns. Verizon doesn't offer this option to

rank-and-file workers.

This is the second year the retirees have asked shareholders to

vote against what it calls Verizon's above-market

retirement-savings plan. At last year's annual meeting, the

proposal won a respectable 28% of the votes cast.

"This is not a vendetta on the part of irate ex-employees," said

the association's chairman, Jack Cohen, 74 years old, who spent 26

years at Verizon. "We try to focus on what is beneficial to all

shareholders. We want the company to succeed."

Bob Varettoni, Verizon's director of corporate communications,

said of the BellTel retirees: "We value their input and appreciate

all that they do just as we value the input of all of our

shareholders."

Proposals aimed at bringing about change in a corporation's

governance practices are generally put forward by activist

investors or big institutional shareholders, such as public pension

funds. It is unusual for former employees of a company to band

together to force such shifts, said Ken Bertsch, executive director

at the Council of Institutional Investors, a nonprofit organization

that focuses on corporate governance and shareholder rights.

The practice of providing executives above-market earnings on

investment options is uncommon, according to Institutional

Shareholder Services, a proxy-advisory service. At Verizon, it

added $73,949 to the $13 million value of Chief Executive Lowell

McAdam's retirement-plan assets in 2017, the association said. The

company's proxy reported no above-market earnings for executives in

2018. Mr. McAdam retired from Verizon at the end of last year.

Verizon has urged shareholders to vote against the retirees'

proposal on above-market earnings, regulatory filings show. The

company says it is inaccurate to characterize the investing option

available to executives as "above-market" because it tracks the

long-term, high-grade corporate bond yield average. It also says

the investing option doesn't increase the cost of executives'

retirement plans.

The idea for the association grew out of Verizon's refusal to

increase pension payouts to retirees in the mid-1990s, said Robert

Rehm, a co-founder along with three other retirees. They formed a

corporation, wrote bylaws and received a nonprofit designation.

"We each threw in $350 of our own money," said Mr. Rehm, 78. "We

started going around to luncheons we knew people were having and

within about six to eight months we had 1,500 retiree names and

addresses. By the end of the second year we had 10,000."

The retiree association's more than 134,000 members are split

evenly between former high-ranking executives and lower-level union

workers; the group is overseen by a 10-person volunteer board that

keeps members up-to-date with quarterly newsletters.

The former union and management employees might have been

adversaries during their work years, but in retirement they "are

all rowing in the same direction," Mr. Cohen said. "We're a very

cohesive group, which was totally out of character when we were

active employees."

In the early days, Verizon executives ignored the association's

inquiries, Mr. Rehm said. Now, company officials respond quickly to

the association's representatives, he said, and meet with them each

fall to discuss issues.

The association's first big win came in 2003 when a proposal to

limit golden parachutes -- payouts for departing executives when

control of a company changes -- passed with 59% support. "This was

the first time in the history of the Bell System that any

shareholder proposal ever won by majority vote," Mr. Rehm said.

Securities and Exchange Commission rules allow any holder of at

least $2,000 worth of a company's stock or 1% of the company for

one year to submit a proposal to be included on its annual proxy

statement and put to a vote of shareholders. The SEC requires

companies to include such proposals on proxies unless it permits

the company to exclude them based on regulations.

Since 2005, Verizon has asked the SEC for permission to exclude

from its proxies 14 of the association's 26 proposals, said Cornish

Hitchcock, a lawyer for the association. The SEC ruled that 10

should be included on the proxies and two excluded. The association

withdrew the other two proposals.

At Verizon's annual meetings, representatives of the retiree

group present its proposals, often with support from outside

shareholders. Verizon agreed to make three of the 11 changes after

a majority of its shareholders favored the association's proposals.

Verizon made the other eight changes suggested by the association

before the proposals went to a shareholder vote.

Among the proposals that won majority support: one in 2007

called for a shareholder vote on pay practices and another in 2013

allowed shareholders to nominate company directors.

"Verizon certainly doesn't love us and they don't agree with us,

even though they've accepted 11 of our governance changes," Mr.

Rehm said. "But we've found they do respect us."

Write to Gretchen Morgenson at gretchen.morgenson@wsj.com

(END) Dow Jones Newswires

April 29, 2019 10:14 ET (14:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

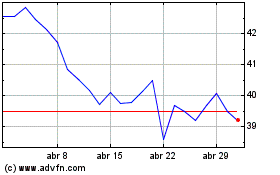

Verizon Communications (NYSE:VZ)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

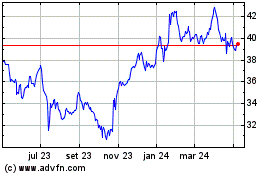

Verizon Communications (NYSE:VZ)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024