By William Watts and Mark DeCambre, MarketWatch

Casino operator Caesars agrees to $8.6 billion buyout

Most major stock benchmarks finished lower on Monday, though the

Dow managed a slight gain, as selling in the energy sector after

President Donald Trump announced "hard-hitting" Iranian sanctions,

dragged the broader market into negative territory.

The Dow Jones Industrial Average rose 8.41 points, or 0.03%, to

close at 26,727.54, but had hit a high at 27,805.52, inching close

to its Oct. 3 record close 26.828.39 before retreating. Meanwhile,

the S&P 500 gave up 0.2% to end at 2,945.35, while the Nasdaq

Composite Index edged 26.01 points, or 0.3%, lower to 8,005.70.

The small-capitalization focused Russell 2000 index finished

down 1.3%, marking its worst one-day drop since May 31, as did the

Dow Jones Transportation Average , which finished the day 1.5%

lower.

Need to Know:Why you should 'keep your eyes open' during this

June rally

(http://www.marketwatch.com/story/why-you-should-keep-your-eyes-open-during-this-june-rally-2019-06-24)

On Monday, U.S.-Iranian tensions escalated, as Trump signed an

executive order targeting financial sanctions against Iran's

leaders, including its Supreme Leader Ayatollah Ali Khamenei.

"I think a lot of restraint has been shown by us -- a lot of

restraint -- and that doesn't mean we're going to show it in the

future," the president said, also asking China and Japan to

shoulder some of the responsibility for protecting key oil "choke

point," the Strait of Hormuz

(http://www.marketwatch.com/story/strait-of-hormuz-oil-choke-point-in-focus-as-iran-shoots-down-us-drone-amid-rising-tensions-2019-06-20).

The U.S. has blamed the Islamic Republic for attacks on tankers

near the waterway, while Iran last week shot down a U.S. drone.

Trump on Friday said he aborted a retaliatory strike against

Iran.

U.S. oil futures ended higher Monday

(http://www.marketwatch.com/story/us-oil-extends-last-weeks-surge-as-us-readies-additional-iran-sanctions-2019-06-24),

but energy stocks, as a group, finished with a loss of 0.9%, making

them the worst performers among the S&P 500's 11 sectors.

Meanwhile, Trump and Xi are set to meet later this week at a

Group of 20 summit in Osaka, Japan, with investors looking for

signs the leaders can work out a truce in a trade war that has

raised concerns about global economic growth and corporate

earnings.

Read:How the Trump-Xi trade meeting could set the stock-market

tone for the summer

(http://www.marketwatch.com/story/how-the-trump-xi-trade-meeting-could-set-the-stock-market-tone-for-the-summer-2019-06-22)

"All the attention will be on Donald Trump and his Chinese

counterpart Xi Jinping and whether they can dial down the mood

music on trade which of late has been set at death metal levels,"

said Russ Mould, director at AJ Bell Investment, in a note. "The

outcome could help set the tone for the markets over the remainder

of the summer."

Trading action otherwise has been lackluster to start the week

thus far, market participants said.

"There has been an absence of major macroeconomic news today and

that has brought about low volatility. Stocks have managed to build

slightly on the gains that were made last week, so traders are

clearly cautiously optimistic about the G-20 summit," wrote David

Madden, market analyst at CMC Markets U.K.

See:Global oil 'choke point' in focus after Trump calls off

military strike against Iran: What you need to know

(http://www.marketwatch.com/story/strait-of-hormuz-oil-choke-point-in-focus-as-iran-shoots-down-us-drone-amid-rising-tensions-2019-06-20)

On Wall Street's radar

Shares of Caesars Entertainment Corp.(CZR) jumped 14.5% after

the casino operator agreed to be bought out

(http://www.marketwatch.com/story/caesars-stock-soars-after-eldorado-buyout-deal-values-casino-operator-at-about-87-billion-2019-06-24)

by Eldorado Resorts Inc.(ERI) in a deal that values the casino

operator at $8.6 billion. Eldorado shares were off 10.6% in Monday

trade.

Shares of Home Depot Inc. (HD) exacted a roughly 26-point toll

on the Dow, with the home-improvement retailer's stock finishing

down 1.9% on no substantial news.

Goldman Sachs Group Inc.'s shares (GS) rose 0.8%, contributing

about 10 points to the price-weighted Dow's gains, while shares of

aeronautics and defense contractor Boeing Co. (BA) added about 15

points. A dollar move in any one of the 30 blue-chip components of

the Dow equates to a roughly 6.8-point swing.

Shares of Palatin Technologies Inc.(PTN) shed 9.7% even after

the Food and Drug Administration granted marketing approval

(http://www.marketwatch.com/story/palatins-stock-rockets-after-fda-ok-to-market-sexual-desire-disorder-treatment-2019-06-24)

for a treatment for hypoactive sexual desire disorder, triggering a

$60 million milestone payment. Shares of the company had been

climbing 27% in premarket trade.

Micron Technology Inc.'s shares (MU)were in focus

(http://www.marketwatch.com/story/micron-could-lose-money-by-year-end-but-its-stock-may-be-near-a-bottom-citi-says-2019-06-24)after

Citigroup analyst Christopher Danely warned that the chip maker

could may lose money by the end of the year, according to Citi, but

its stock could be nearing a bottom. Shares rose 0.8%.

Shares of auto maker Daimler AG(DAI.XE) fell 3.8% in German

trading

(http://www.marketwatch.com/story/daimler-issues-profit-warning-over-costly-diesel-issues-2019-06-24)

after it warned that second-quarter profits would be high by

increased charges surrounding problems with diesel vehicles from

its Mercedes-Benz brand. Daimler also downgraded its full-year

earnings forecast.

Daimler's performance weighed on Germany's DAX stock index ,

while European stocks traded mostly lower. The Stoxx 600 Europe

Index ended 0.3% lower.

A weak reading for a closely followed German business sentiment

index did little to soothe worries over the global economic

outlook. The Ifo business-climate index fell to 97.4 in June

(http://www.marketwatch.com/story/german-business-sentiment-continues-to-deteriorate-2019-06-24-54853020),

its lowest since November 2014, from 97.9 in May. Economists had

forecast a reading of 97.6.

How were other assets trading?

Overnight Thursday Asian stocks were mixed with Hong Kong's Hang

Seng Index edged up 0.1%, China's Shanghai Composite Index gained

0.2%, and Japan's Nikkei 225 picked up 0.1%.

Gold futures extended gains

(http://www.marketwatch.com/story/gold-resumes-rally-pushing-further-past-1400-2019-06-24),

settling at $1,418.20 an ounce.

The 10-year Treasury yielded 2.021%

(http://www.marketwatch.com/story/treasury-yields-slip-ahead-of-trump-xi-meeting-2019-06-24),

and the U.S. dollar, as measured by the ICE U.S. Dollar Index ,

retreated 0.2% against its peers.

(END) Dow Jones Newswires

June 24, 2019 16:44 ET (20:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

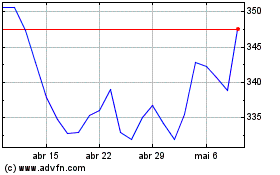

Home Depot (NYSE:HD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Home Depot (NYSE:HD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024