Dow Industrials on Pace to Notch Record High

03 Julho 2019 - 12:45PM

Dow Jones News

By Lauren Almeida and Michael Wursthorn

The Dow Jones Industrial Average rose a fourth straight session,

pushing the blue-chip index above its record closing level in

intraday trading Wednesday.

The Dow industrials gained 92 points, or 0.3%, ahead of its

early close Wednesday before Thursday's Independence Day holiday.

The index surpassed its Oct. 3 milestone soon after the opening

bell and would be the last of the major U.S. benchmarks to hit a

record this year. Shares of UnitedHealth Group and Home Depot led

the 30-stock index higher, as investors continued their steady

buying of stocks this week.

Indexes have been climbing, albeit slowly, since last weekend's

truce between the U.S. and China eased investors' fears of an

all-out trade war between the world's two biggest economies. But

the cease-fire only put additional tariffs on hold indefinitely,

leaving investors concerned that lingering frictions could give way

to another flare-up in trade tensions and market volatility.

Eyes now turn to the Federal Reserve and whether it will cut

interest rates this year -- a move that would support further stock

gains, analysts said.

Investors largely expect the central bank to slash rates at one

of its coming meetings, according to CME Group data. Weakening

economic figures, including slowing U.S. factory activity and a

pullback in hiring activity, help support such a move, as do trade

tensions, analysts said. Although it remains unclear if the trade

truce will affect the Fed's decision, money managers say the June

jobs report, due Friday after the July 4 holiday, will also factor

into the central bank's thinking.

"With the modestly positive agreement to restart trade

negotiations between the U.S. and China, the bullish narrative now

pivots to the Fed meeting at the end of July, when it is

overwhelmingly expected to lower the overnight rate by a quarter

point," said Ameriprise Chief Market Strategist David Joy.

On Wednesday, shares of UnitedHealth Group led the Dow

industrials higher, followed by Home Depot and Procter & Gamble

to help lift the index above its Oct. 3 record of 26828.39. The Dow

also previously topped its record closing level in intraday trading

last month and again Monday but fell back below the record before

markets closed.

The S&P 500 also edged higher, adding 0.5% Wednesday as all

11 major sectors notched gains. The Nasdaq Composite also rose,

adding 0.6%.

Shares of Symantec led the S&P 500 higher, adding 15% after

the company landed takeover interest from Broadcom, which declined

2.4% in recent trading. Real-estate stocks, meanwhile, notched the

biggest gains, rising 1.2%, while shares of utilities and consumer

staples both rose 0.9% each.

Tesla rose 5.5% after the car maker said Tuesday it had

delivered a record 95,200 vehicles in its latest quarter.

Elsewhere, the Stoxx Europe 600 added 0.8%, as shares of travel

companies and food and beverage firms pushed the pan-European

benchmark higher.

Asian stock markets, meanwhile, fell, with South Korea leading

losses as the Kospi slipped 1.2% after the country lowered growth

and inflation forecasts. Chinese stocks also declined, as the

Shanghai Composite and the Hong Kong's Hang Seng shed 0.9% and

0.1%, respectively.

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com

(END) Dow Jones Newswires

July 03, 2019 11:30 ET (15:30 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

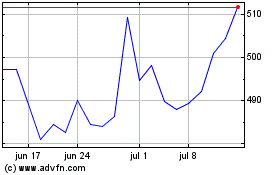

UnitedHealth (NYSE:UNH)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

UnitedHealth (NYSE:UNH)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024