Health-Care Rally Helps Lift Dow Over 27000

11 Julho 2019 - 1:20PM

Dow Jones News

By Nathan Allen and Michael Wursthorn

A rally in health-care stocks pushed the Dow Jones Industrial

Average over 27000 for the first time after the Trump

administration abandoned a plan to curb drug rebates.

The decision canceled a plan that would have eliminated rebates

from government drug plans, easing concerns of a massive disruption

to the U.S. pharmaceutical industry.

Shares of UnitedHealth jumped 5.1%, leading the Dow industrials

higher. Meanwhile, Cigna and CVS Health added 12% and 5.7%,

respectively, helping the S&P 500 notch a slim gain in recent

trading.

The Dow industrials gained 198 points, or 0.7%, to 27059, while

the S&P 500 added 0.2%. The Nasdaq Composite rose 0.2%. Major

U.S. indexes extended their gains from Wednesday's session, helping

to reverse stocks' recent faltering amid concerns that investors

were overestimating the likelihood of a rate cut. Federal Reserve

Chairman Jerome Powell's dovish comments and minutes from the Fed's

June policy meeting reassured traders that further easing is the

most likely course of action.

Mr. Powell is speaking again on Thursday, though analysts don't

expect him to provide much new information. U.S. consumer-inflation

data will be in focus, as weak inflation would support the case for

further monetary easing.

"Powell needs a low inflation number to bolster the rate-cut

case. If it proves to be just like last week's employment read and

also comes in strong, then perhaps we've all been overeager for a

cut," said Mike Loewengart, head of investment strategy at

E*Trade.

U.S. government-bond yields, meanwhile, extended early gains

after data showed that consumer prices rose in June, a sign

inflationary pressures could be stabilizing after a period of

weakness. Core inflation, which strips out volatile food and energy

prices, rose faster than expected. The yield on 10-year U.S.

Treasurys climbed to 2.087% from 2.061% a day earlier. Bond prices

and yields move in opposite directions.

Elsewhere, minutes from the European Central Bank's June policy

meeting showed that officials are likely to consider injecting

fresh stimulus into the eurozone in light of weak inflation data.

The minutes suggest policy makers will weigh cutting the bank's key

interest rate or restarting its EUR2.6 trillion ($2.92 trillion)

bond-buying program.

Stocks in Europe edged lower, reversing an earlier gain, as the

pan-continental Stoxx Europe 600 declined 0.2%.

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com

(END) Dow Jones Newswires

July 11, 2019 12:05 ET (16:05 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

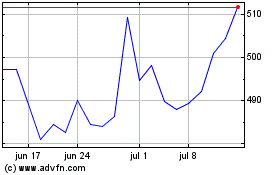

UnitedHealth (NYSE:UNH)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

UnitedHealth (NYSE:UNH)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024