WPP Sells Market-Research Stake -- WSJ

13 Julho 2019 - 4:02AM

Dow Jones News

By Nick Kostov

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 13, 2019).

WPP PLC has agreed to sell a 60% stake in market-research firm

Kantar to Bain Capital Private Equity, raising about $3.1 billion

in the advertising giant's biggest move yet to refocus its

portfolio.

London-based WPP, which will retain 40% of Kantar, said Friday

it plans to return $1.2 billion to shareholders and use the rest of

the sale proceeds to reduce debt.

The sale of the Kantar stake comes as established advertising

companies like WPP face a range of challenges, from increased

competition due to consulting firms encroaching on their turf, to

the growing power of Facebook Inc. and Alphabet Inc.'s Google.

Since taking the helm in September, WPP chief Mark Read has

moved to pare down the sprawling ad empire as marketers look to

work with agencies that are more nimble and tech savvy. Kantar, in

particular, has weighed on WPP's results, as clients in recent

years have turned to other sources for marketing help.

Mr. Read, who became chief executive after the abrupt departure

of longtime leader Martin Sorrell, quickly combined its Young &

Rubicam creative agency with digital-ad firm VML in a bid to

bolster lackluster performance. Soon after, the 52-year-old Briton

merged storied creative agency J. Walter Thompson and digital

specialist Wunderman.

In recent weeks, WPP has also sold its majority stake in

postproduction company The Farm as well as its stake in Chime Group

Holdings, a communications and sports-marketing business. Still,

the sale of a majority stake in Kantar marks Mr. Read's biggest

move so far.

Kantar offers research, data, social-media moderating and other

services to help companies tailor their brands, advertising

campaigns and products to their target market. But its customers

have sought out less labor-intensive digital sources for customer

insights.

"Data is critical to WPP's clients and critical to WPP, but

there's a growing number of sources of data," Mr. Read told

reporters Friday, adding that the company should focus on

"data-driven marketing rather than data ownership."

Including debt, the stake sale values Kantar at about $4

billion. Bain got the edge over a group of other buyout firms

bidding for Kantar when at the start of the month WPP announced the

pair had entered exclusive talks.

The U.S. private-equity group can now attempt a turnaround at

Kantar away from the glare of public markets. If Bain succeeds, WPP

stands to benefit through its minority stake in Kantar.

Luca Bassi, a managing director at Bain, said there were

opportunities to invest in Kantar's technology and expand its

capabilities. "Market research remains the cornerstone of business

decision making," Mr. Bassi said. "All over the world all companies

and industry will require more data, and more solutions to analyze

and interpret that data."

WPP expects the deal to be largely complete by early 2020,

although it remains subject to approval from the company's

shareholders and regulators.

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

July 13, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

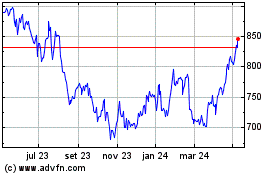

Wpp (LSE:WPP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Wpp (LSE:WPP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024