Citigroup Gets Lift From Consumers, as Trading, M&A Slow -- WSJ

16 Julho 2019 - 4:02AM

Dow Jones News

Bank beats analysts' expectations as one-time gain lifted EPS

and trading revenue

By Telis Demos

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 16, 2019).

Strong U.S. consumer banking gave Citigroup Inc. a boost in the

second quarter, helping it overcome slow trading and corporate

activity.

Citigroup said Monday its second-quarter net income rose 7% from

a year ago. Quarterly profit was $4.8 billion, from $4.5 billion

from a year ago. Per-share earnings were $1.95 a share. Analysts

had expected $1.81 a share.

Revenue at the bank was $18.76 billion, up 2% from $18.47

billion a year ago. Analysts polled by Refinitiv had expected $18.5

billion.

Citigroup is the first of the big U.S. banks to report

second-quarter results. The New York bank and its rivals have been

under pressure in recent months. On the Wall Street side of the

business, tepid market volatility is hurting trading desks. On the

Main Street side, banks are grappling with the prospect of lower

interest rates. The Federal Reserve had been raising rates since

late 2015, which boosted banks' lending profitability. But the

central bank is now signaling it is ready to cut rates.

"We're clearly pivoting from an environment where we had

predicted...rising rates to this point," Chief Executive Michael

Corbat told analysts. "From our perspective we don't believe that

the market has made that full adjustment."

Trading revenue at Citigroup was up 4% to $4.1 billion, but that

included a one-time gain on the bank's stake in a trading platform.

Without that gain, Citigroup's core trading revenue declined 5%

from a year ago.

On that basis, it would be the third straight quarter of

declines in the trading unit. Banks have warned that despite record

stock markets, clients have remained cautious and weren't paying

their banks to help them put on big new bets.

The one-time gain in trading also flattered the bank's earnings

per share. Without it, the bank would have earned $1.83 per

share.

Overall corporate and institutional banking revenue was flat for

the quarter, at $9.72 billion. Investment banking revenue fell 10%,

driven by a 36% drop in fee revenue from advising companies on

mergers and acquisitions.

Large multinational companies are the backbone of Citigroup's

business. Executives said those clients' borrowing decisions are

sensitive to ongoing trade tensions, such as the simmering and

unresolved discussions between the U.S. and China.

"There's a bit of caution that corporate clients are exercising,

and in particular in Asia," Chief Financial Officer Mark Mason said

to reporters. "It's a byproduct of the trade tensions impacting

demand for corporate lending there."

But the bank generated solid growth from its consumer unit.

Global consumer banking revenue at Citigroup was up 3% to $8.51

billion.

The bank's U.S. retail presence lags behind peers in many

respects, but the bank has been investing heavily to expand it,

particularly through digital and mobile banking. Revenue for U.S.

consumer banking was up 3% to $5.16 billion, driven by a pickup in

Citigroup's branded cards, where revenue grew 7% to $2.20 billion.

The bank has been letting many of its promotional

zero-interest-borrowing card offers lapse, leading to a revenue

pickup.

But there are also signs that customers continue to demand

higher deposit rates, which could squeeze banks' profitability.

Even though the Fed has signaled it might cut rates, Citigroup said

commercial customers such as small businesses and giant

corporations continued to press for higher deposit rates or to move

money out of noninterest accounts.

Citigroup's cost of deposits continued to rise. The bank's

average rate paid on deposits rose to 1.53%, from 1.46% at the end

of the first quarter.

"It's a little bit hard to pinpoint exactly when that

stabilizes," Mr. Mason told analysts. "There are other factors,

such as the competitive landscape out there for deposits."

Citigroup is trying to meet 2020 financial targets closely

watched by investors, which makes this year's results crucial.

For the quarter, Citigroup produced a return on tangible common

equity of 11.9%. The bank is aiming for a return of 12% this

year.

In June, Citigroup won approval from the Federal Reserve to pay

out another $21.5 billion to investors in dividends and buybacks in

the next 12 months.

The bank continued to slash costs. Expenses were down 2% to

$10.5 billion.

Citigroup shares fell 0.1% on Monday. It has led major banks

with a 38% gain so far in 2019. The broader KBW Nasdaq Bank index

is up 15% this year.

Write to Telis Demos at telis.demos@wsj.com

(END) Dow Jones Newswires

July 16, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

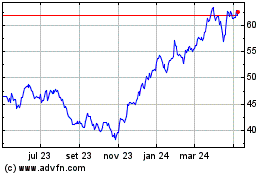

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

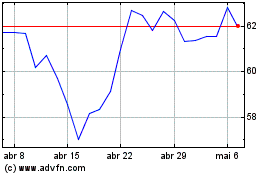

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024