Citi's Mixed Results Underscore Global Risks

16 Julho 2019 - 4:14AM

Dow Jones News

By WSJ City

Citigroup's quarterly results on Monday reflected the

conventional wisdom about the current state of the global economy:

US consumers are going strong while corporate sentiment --

particularly in Asia -- is weakening due to trade tensions, writes

Aaron Back for Heard on the Street. But there is another message in

the results: the threat of lower interest rates that hangs over

Citi and all of its US peers.

KEY POINTS

-- The most international US bank reported better-than-expected earnings for

the second quarter.

-- That's largely due to a one-time gain on a stake it holds in electronic

bond-trading platform Tradeweb.

-- Excluding this, earnings were more or less in line with estimates.

-- The bank's global consumer business performed well with revenue growing

by 4% from a year earlier.

-- Its branded US credit cards thrived with revenue shooting up 7% from a

year earlier to $2.2bn.

Analysis

Citi's corporate business was less robust. Business lending in

Asia hasn't grown for three straight quarters and was down 7% from

a year earlier in the second quarter. This isn't a small business,

with $63bn of loans outstanding in the second quarter, or around

18% of Citi's institutional loans world-wide. On a conference call,

CFO Mark Mason confirmed that US-China trade tensions have hurt

companies' appetite to borrow in the region. Citigroup is more

exposed to this than US peers.

That same international footprint means Citigroup is

less-affected than many American banks when the Federal Reserve

cuts rates, as it is expected to later this month. Nonetheless, the

impact would be significant.

A fuller story is available on WSJ.com

WSJ City: The news, the key facts and why it matters. Be deeply

informed in less than five minutes. You can find more concise

stories like this on the WSJ City app. Download now from the App

Store or Google Play, or sign up to newsletters here

http://www.wsj.com/newsletters?sub=356&mod=djemwsjcity

(END) Dow Jones Newswires

July 16, 2019 02:59 ET (06:59 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

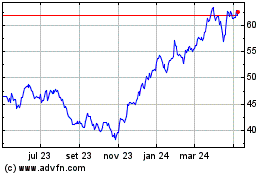

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

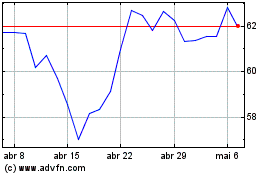

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024