BP Boosts Its Biofuels Business with Brazilian Joint Venture

22 Julho 2019 - 11:58AM

Dow Jones News

By Sarah McFarlane

Energy giant BP PLC is doubling down on biofuels with a joint

venture with agricultural trader Bunge Ltd. in Brazil, betting that

the global movement to reduce carbon emissions will boost demand

for low-carbon fuels.

The two companies have combined their sugar and ethanol

businesses to create the second-largest sugar cane crushing

operation in Brazil, called BP Bunge Bioenergia. The venture will

produce ethanol from sugar cane.

Ethanol's greenhouse gas emissions are around 70% lower than

hydrocarbon transport fuels, and around 70% of vehicles in Brazil

can run on ethanol. The joint venture will also produce electricity

from the waste biomass of the sugar cane.

BP will pay Bunge $75 million and the equally owned joint

venture will assume $700 million of non-recourse debt associated

with Bunge's assets. The stand-alone joint venture includes BP's

three sugar cane crushing mills and Bunge's eight mills, with

combined capacity to crush 32 million metric tons a year.

The mills yield around 60% ethanol and 40% sugar, and there is

some flexibility to adjust these ratios, said Dev Sanyal, chief

executive of BP Alternative Energy.

Some countries, including Brazil and the U.S., mandate a minimum

amount of ethanol is blended with gasoline. Brazil is already the

world's leading biofuels market as a share of the country's

transport fuel mix.

"Biofuels will be an essential part of delivering the energy

transition and Brazil is leading the way in showing how they can be

used at scale, reducing emissions from transport," said Bob Dudley,

BP chief executive.

Brazil is the world's second largest ethanol market behind the

U.S., having adopted policies to use more biofuels in the 1970s

when oil prices surged after the Organization of the Petroleum

Exporting Countries halted exports to some countries.

The joint venture follows a similar move by Royal Dutch Shell

PLC and Brazilian sugar and ethanol producer Cosan Industria e

Comercio SA in 2010, when they formed Brazil's top cane crusher

Raizen.

Sugar producers have struggled with lower prices in recent years

with booming output in top-producing nations, including India and

Thailand, causing global stocks to build.

Meanwhile, Brazil's ethanol market has been supported by strong

demand. The government plans to introduce new mandates for fuel

distributors to increase their biofuel sales from 2020.

Bunge started reviewing its South American sugar business in

2013 and had looked at options including a sale or initial public

offering, the company has said. It sold its sugar trading business

to Wilmar International Ltd in August last year.

Write to Sarah McFarlane at sarah.mcfarlane@wsj.com

(END) Dow Jones Newswires

July 22, 2019 10:43 ET (14:43 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

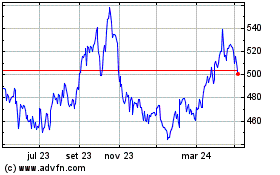

Bp (LSE:BP.)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

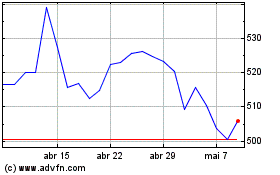

Bp (LSE:BP.)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024