Global Stocks Rise With Eyes on Trade

11 Setembro 2019 - 8:07AM

Dow Jones News

By Anna Isaac

-- Dow futures up, S&P 500 futures flat

-- Treasury yields rise

-- Asian, European stocks climb

Global stocks gained Wednesday after China exempted certain U.S.

products from higher tariffs ahead of trade talks planned for next

month.

Futures for the Dow Jones Industrial Average edged up 0.1%. The

contracts don't necessarily predict moves after the opening

bell.

The Stoxx Europe 600 rose 0.6% in late-morning trade, with

Germany's DAX up 1% and France's CAC 40 up 0.4%.

Shares in the London Stock Exchange Group PLC gained 4.9% after

Hong Kong Exchanges & Clearing Ltd. made an offer to buy it in

a $36.56 billion cash-and-share deal.

Meanwhile, shares in Prosus, the Naspers Ltd. spinoff, had their

debut on Amsterdam's Euronext. A valuation of nearly EUR120 billion

($132.51 billion) made it Europe's largest listed consumer internet

company.

China said Wednesday that higher tariffs wouldn't be levied

against a variety of U.S. imports for a year, starting Sept. 17,

and that it would continue to review more goods for exemption.

Hong Kong's Hang Seng led gains, climbing 1.8%, while Japan's

Nikkei rose 1%. The Shanghai Composite was the exception, with a

fall of 0.4%.

Korea's Kospi climbed 0.8% after positive jobs data from the

country helped to bolster confidence in its economy, suggesting

that government stimulus efforts were proving fruitful.

In Europe, Zara-owner Industria de Diseno Textil SA, the world's

largest fashion retailer by sales, saw its share price fall 2.5%

after it reported earnings for the first half of the year.

Investors have shown signs in recent days of expecting less

stimulus from the European Central Bank when it meets on

Thursday.

"Ahead of the ECB meeting investors seemed to take some chips

off the table with aggressive expectations being pared back," said

Antoine Bouvet, senior rates strategist at ING Bank in a note.

The yield on the benchmark 10-year German bund was at minus

0.545% on Wednesday. Meanwhile, U.S. 10-year Treasury yields rose

to 1.718%, from 1.706% on Tuesday. Bond yields and prices move in

opposite directions.

The drivers for rising yields included better news on U.S.-China

trade and a reduced likelihood of a no-deal Brexit, according to

Oliver Jones, market economist at Capital Economics.

Higher yields may offer relief for major banks, easing pressure

on their balance sheets after negative interest rates have eaten

into profits in Europe. The banking sector within Europe's Stoxx

600 climbed 1.4%, marking its sixth- straight day of gains.

In commodities, oil prices rebounded from losses that came after

President Trump ousted John Bolton as his national security

adviser. Brent crude, the global benchmark, was up by 1.2% at

$63.12 a barrel.

Write to Anna Isaac at anna.isaac@wsj.com

(END) Dow Jones Newswires

September 11, 2019 06:52 ET (10:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

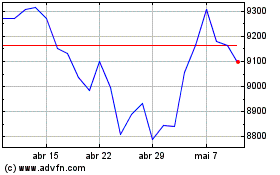

London Stock Exchange (LSE:LSEG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

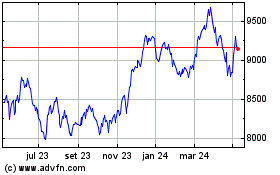

London Stock Exchange (LSE:LSEG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024