By Steven Russolillo and Ben Dummett

Hong Kong's stock exchange made an unsolicited $36.6 billion

offer to acquire its London-based rival, a deal that would unite

two of the world's major trading hubs when both are under severe

political pressure.

Hong Kong is reeling from a summer of increasingly violent

protests, with scenes of tear gas and Molotov cocktails playing out

virtually every weekend on live television. London, meanwhile, is

gripped by political paralysis as successive governments fail to

find a way to implement an exit from the European Union due to take

place next month. Bankers in both cities are trying to figure out

whether things could get bad enough to force them to move out.

And yet Hong Kong Exchanges & Clearing Ltd. has picked this

moment to launch what would be its biggest deal. A combination with

the London Stock Exchange would create a global leader in capital

flows and financial data by connecting developed and emerging

markets in the East and West. It would also thwart the LSE's

ambitions to transform itself from an exchange into a full-fledged

data business by acquiring financial-information provider Refinitiv

Holdings Ltd., which used to be part of Reuters, for $14.5 billion

in stock.

Data is expected to be a key battleground for exchanges in the

coming years as many rethink their historical reliance on listing

and trading companies and look for new revenue streams based on the

vast amounts of data flowing through them.

"You don't choose timing, you choose what is the right thing to

do," Charles Li, chief executive of the Hong Kong exchange, said

during a conference call Wednesday.

"This has nothing to do with Hong Kong's situation," he

added.

The London exchange criticized the offer as "preliminary and

highly conditional." It said it would consider the proposal but

remains committed to the Refinitiv deal.

"We are here like a corporate Romeo and Juliet," Mr. Li, said on

the conference call. "We know we were late. ...We want to openly

express our admiration."

The Hong Kong exchange could face significant political hurdles

to completing a deal. A number of transactions have been scuttled

by concerns about Chinese access to sensitive data, and financial

information is high on the sensitivity index. Hong Kong enjoys

significant autonomy from China -- with a separate legal system and

freely convertible currency -- but recent political moves have

tested those boundaries.

"Any regulator would need to think carefully about the

implications of the political situation and Beijing's increasing

control over Hong Kong, " said David Webb, an outspoken private

investor in Hong Kong. "This strikes me as an aspirational proposal

that probably won't go through."

The Hong Kong exchange said its offer -- valued at GBP29.6

billion in cash and stock -- represents a 22.9% premium to the

London exchange's closing stock price on Tuesday. It proposed

paying roughly a quarter of the purchase price in cash and the rest

in stock.

"This is an audacious move," said Larry Tabb, founder and

research chairman of the financial markets research and advisory

firm Tabb Group. "LSE is one of the few really prestigious global

exchange brands."

LSE shares, which have soared following the Refinitiv deal

announcement, jumped as much as 16% Wednesday before trimming some

gains.

The London Stock Exchange, which traces its history back

hundreds of years, has proven one of the world's most difficult

acquisition targets over the past two decades. German rival

Deutsche Boerse AG has twice failed to take over the exchange, as

has the technology-heavy U.S. exchange Nasdaq Inc. A Swedish

exchange and Australian investment bank Macquarie Group also

haven't completed takeovers.

"This deal seems so out of left field, especially after

Refinitiv," said Brad Bailey, research director for capital markets

at Celent in New York. "I was very surprised."

If the Hong Kong exchange's bid for LSE succeeds, it would

create an Asian-European giant that would rival the two biggest

players in the global exchange business, both of them U.S. firms:

Chicago-based CME Group Inc. and Atlanta-based Intercontinental

Exchange Inc., or ICE.

CME has a market capitalization of over $72 billion, while ICE

-- the parent of the New York Stock Exchange -- is worth about $50

billion. Both U.S. firms rode a wave of consolidation in the

exchange business over the past two decades to amass more heft than

their European and Asian rivals.

Mr. Li, in a blog post on the Hong Kong exchange's website, said

the proposal comes after "many months of consideration" and marks a

milestone for the city, which has built itself into a global

financial center as China's economic growth has accelerated. He

said a partnership between the two exchanges "will strengthen ties

between the U.K. and China, particularly in economic and trade

terms."

Illustrating the unrest's pressure on Hong Kong's economy,

flagship carrier Cathay Pacific said Wednesday that its inbound

traffic fell 38% in August from a year earlier amid a slump in

tourism. Outbound trips also took a hit, and Cathay said

premium-class travel fell more than leisure travel, a sign of

pressure on business. The company expects September to be just as

difficult and said it was slowing its capacity additions for the

year.

The Hong Kong exchange first approached the LSE after the U.K.

exchange operator announced its deal with Refinitiv, and the two

sides have held preliminary discussions, according to a person

familiar with the matter.

The Hong Kong exchange decided to make its offer public so that

shareholders of both companies could assess its merits, the person

said.

"We are looking forward to further conversations and to take a

deeper dive," Mr. Li said on Wednesday.

The Hong Kong exchange dominates its home market and has thrived

by plugging mainland China into the global financial system,

initially through hosting stock listings, and more recently through

trading arrangements that connect the world's investors to

otherwise hard to access markets in Shenzhen and Shanghai.

Last year it made a record profit of roughly $1.2 billion, equal

to nearly 59 cents out of every dollar it took in as revenue or in

other ways, chiefly as income on investments.

Hong Kong is a crucial throughway for capital flows into and out

of China. The exchange was the world's biggest for initial public

offerings last year, lifted by multibillion-dollar share sales by

several of China's most valuable technology and internet

companies.

The dollar value of new listings in Hong Kong has shrunk sharply

this year, and trading has slowed, as trade tensions, China's

economic slowdown and unrest in the city have dented market

sentiment.

Companies raised $9.5 billion via Hong Kong IPOs in the year

through Wednesday, or roughly 40% of the total raised in the same

period last year, according to Dealogic. In July, Anheuser-Busch

InBev SA halted a near-$10 billion listing of its Asian unit,

blaming market conditions.

In August, the average daily turnover of securities traded on

HKEX fell 8.4% from a year earlier.

On Wednesday, however, China's Shanghai Henlius Biotech Inc.

began taking orders for an IPO worth up to $477 million, in what

would be the city's first sizable listing since July, and some

other companies are also gearing up for substantial market

debuts.

Julie Steinberg and Alexander Osipovich contributed to this

article.

Write to Steven Russolillo at steven.russolillo@wsj.com and Ben

Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

September 11, 2019 12:11 ET (16:11 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

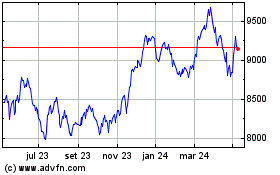

London Stock Exchange (LSE:LSEG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

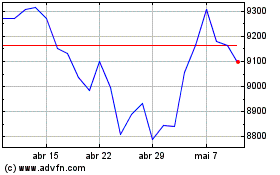

London Stock Exchange (LSE:LSEG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024