By Simon Clark, Anna Isaac and Alexander Osipovich

The U.K. government could refuse to approve a potential $36.6

billion takeover of London Stock Exchange Group PLC by its Hong

Kong rival because it forms too critical a part of the country's

financial infrastructure, according to people familiar with the

matter.

Officials at the Bank of England, who informally advise the U.K.

Treasury, believe that the London Stock Exchange's clearing arm,

LCH constitutes crucial market plumbing, according to a person

familiar with the matter. This would make any tie-up unlikely to

successfully pass government scrutiny on concerns about financial

stability and security, they said.

"The London Stock Exchange is a critically important part of the

U.K. financial system, so as you would expect, the government and

the regulators will be looking at the details closely," a

spokesperson for the U.K. Treasury said. "We cannot comment further

on commercial matters."

U.S. regulators will also have a say in whether a deal can

proceed if the offer gains traction.

Hong Kong Exchanges & Clearing Ltd. made an unsolicited

offer Wednesday in an attempt to thwart London Stock Exchange's

$14.5 billion takeover of financial-information provider Refinitiv

Holdings Ltd. LSE said it remains committed to the Refinitiv

deal.

The London exchange has hundreds of U.S. employees and operates

businesses that are regulated by the Securities and Exchange

Commission, the Commodity Futures Trading Commission and the

Financial Industry Regulatory Authority.

The Committee on Foreign Investment in the U.S., which

scrutinizes politically sensitive takeovers, would also likely have

a say.

"Cfius has jurisdiction," said Nova Daly, a policy adviser at

Washington law firm Wiley Rein LLP who previously ran the Cfius

process as deputy assistant secretary at the Treasury Department. A

Cfius spokesman declined to comment.

Takeovers of stock exchanges are often fraught with political

and regulatory obstacles. Germany's Deutsche Boerse AG, Nasdaq Inc.

and Sweden's OM Group have all made failed bids for the London

exchange. The Hong Kong exchange could also face significant

hurdles, particularly at a time of fractious geopolitics dominated

by a trade war between the U.S. and China.

"Once you go cross-border, generally, you get many people asking

all kinds of questions like who's running the company, what's the

board structure and, of course, the national aspect behind the

company," said Brad Bailey, research director for capital markets

at Celent in New York. "There would be a lot of mixed feelings

around what would happen should a deal happen."

The London exchange has U.S. employees in "major hubs" in New

York City, Fort Mill, S.C., Buffalo, N.Y., and Seattle, a

spokeswoman said. The CFTC and SEC regulate its LCH SA unit, the

CFTC regulates its LCH Ltd. unit and the SEC and Finra regulate its

MTS Markets unit, the spokeswoman said.

"There will be significant U.S. government concern about the

security of data and influence of capital flows that could result

from the transaction," said a senior Washington lawyer who

specializes in Cfius cases.

The history of the exchange business over the past decade is

riddled with failed cross-border deals. Many of these were blocked

by regulators out of concerns that a prized national asset would be

taken over by foreigners, or that the takeover would give the

combined company monopolistic pricing power in crucial financial

markets.

In 2017, the European Union blocked a proposed tie-up between

Deutsche Börse and London Stock Exchange, ending an effort to

create a pan-European exchange champion. EU regulators rejected the

deal on antitrust grounds, but the deal was also roiled by

Britain's vote to exit from the EU just a few months after the deal

was agreed.

In 2012, the EU rejected an $18.1 billion merger between

Deutsche Börse and NYSE Euronext, which was then the parent company

of the New York Stock Exchange, also on antitrust grounds.

In 2011, London Stock Exchange agreed to merge with Canada's TMX

Group, the operator of Canada's flagship Toronto Stock Exchange, in

a bid to become a trans-Atlantic exchange group. But that deal

foundered after a homegrown, competing bid emerged from a group of

Canadian banks and asset managers. The group, which dubbed

themselves Maple Group Acquisition Corp. in an allusion to the

Canadian flag, ultimately took control of TMX.

Also in 2011, authorities in Australia blocked a proposed

takeover of ASX, that country's main stock-market operator, by

Singapore Exchange Ltd. Canberra said the $8.9 billion deal offered

little for the resource-rich Pacific nation and raised the risk of

Australia losing control of its clearing and settlement

systems.

Even deals within the same country can face a steep hurdle in

clearing antitrust review. In 2011, the U.S. Justice Department

killed an effort by Nasdaq to take over the NYSE, saying it would

lead to too much concentration in the U.S. stock-exchange

business.

Steven Russolillo

contributed to this article.

Write to Simon Clark at simon.clark@wsj.com, Anna Isaac at

anna.isaac@wsj.com and Alexander Osipovich at

alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

September 11, 2019 15:52 ET (19:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

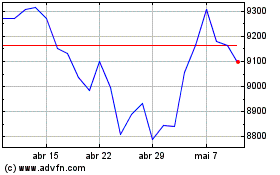

London Stock Exchange (LSE:LSEG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

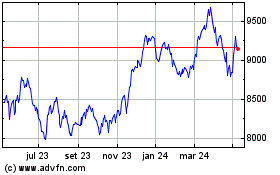

London Stock Exchange (LSE:LSEG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024