London Stock Exchange Rejects Bid From Rival Hong Kong Exchange -- Update

13 Setembro 2019 - 10:09AM

Dow Jones News

By Margot Patrick

LONDON -- London Stock Exchange Group PLC on Friday rejected a

$36.6 billion bid from Hong Kong Exchanges and Clearing Ltd.,

saying it had "fundamental concerns" about the price and Hong

Kong's long-term future as a financial gateway.

The U.K. operator said it remains committed to buying

financial-information and terminal company Refinitiv Holdings Ltd.,

a $14.5 billion deal it struck in July that would have been

scrapped if the Hong Kong exchange succeeded in its bid.

Shares in LSE were about 2% higher after the rejection, having

already risen almost 6% on Wednesday after HKEX announced its

offer.

The bid surprised investors. A successful tie-up looked like a

long shot to many analysts because of regulatory and political

hoops. Hong Kong is reeling from a summer of antigovernment

protests that have raised concerns about China's tightening grip on

the financial center.

In a letter to the Hong Kong exchange issued publicly, LSE

Chairman Don Robert said the proposal didn't meet LSE's strategic

objectives and has "serious deliverability risk."

He said LSE's board doesn't believe HKEX is the best partner for

its long-term positioning in Asia, and said the Shanghai Stock

Exchange, which it has business agreements with, is its preferred

channel to access opportunities with China.

"There is no doubt that your unusual board structure and your

relationship with the Hong Kong government will complicate

matters," Mr. Robert said.

Write to Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

September 13, 2019 08:54 ET (12:54 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

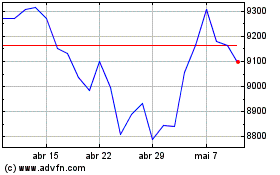

London Stock Exchange (LSE:LSEG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

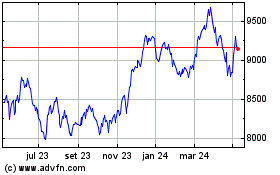

London Stock Exchange (LSE:LSEG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024