London Stock Exchange Rejects Bid From Rival Hong Kong Exchange -- 2nd Update

13 Setembro 2019 - 1:22PM

Dow Jones News

By Margot Patrick

LONDON -- London Stock Exchange Group PLC on Friday rejected a

$36.6 billion bid from Hong Kong Exchanges and Clearing Ltd.,

saying it had "fundamental concerns" about the price and Hong

Kong's long-term future as a financial gateway.

The U.K. operator said it remains committed to buying

financial-information and terminal company Refinitiv Holdings Ltd.,

a $14.5 billion deal it struck in July that would have been

scrapped if the Hong Kong exchange succeeded in its bid.

Shares in LSE were 2% higher after the rejection, having already

risen almost 6% on Wednesday after HKEX announced its unsolicited

offer, surprising investors. Analysts say HKEX could improve its

offer with a larger cash component, or that other exchanges may

want to bid for the London exchange.

A successful tie-up between LSE and HKEX looked like a long shot

to many analysts because of regulatory and political hoops. Hong

Kong is reeling from a summer of antigovernment protests that have

raised concerns about China's tightening grip on the financial

center. London is grappling with its own political upheaval in the

form of Brexit.

The history of the exchange business over the past decade is

riddled with failed cross-border deals. Many of these were blocked

by regulators out of concerns that a prized national asset would be

taken over by foreigners, or that the takeover would give the

combined company monopolistic pricing power in crucial financial

markets. Exchanges themselves have often failed to agree on deal

terms and how to structure a combined entity.

The bid from Hong Kong was the latest for LSE, which has become

a highly sought-after target for a range of suitors over several

years, attracting multiple bids and making multiple acquisitions of

its own. The group, which has been offering stock trading for more

than 200 years, now derives much of its value from data services

and the popularity of passive investing.

Revenue from LSE's clearing house and financial indexing

business far outstrips a 20% contribution from its more traditional

exchange businesses of floating companies and securities trading.

That was the big lure for the Hong Kong exchange group.

LSE's stock has soared ninefold in the past 10 years, compared

with a 47% rise in the FTSE 100 index of the U.K.'s largest

companies. It had risen 80% this year even before the HKEX

offer.

That performance sets it apart from other U.K. financial

companies such as banks whose stocks have been dragged down by low

interest rates and stricter regulation since the financial crisis.

In contrast, LSE has benefited from postcrisis rules pushing more

derivatives through its LCH clearing house and a boom in indexed

funds.

Tracing its roots to City of London coffee houses where

stockbrokers set up shop, LSE thrived as London established itself

as a global hub for company fundraising and trading. It floated its

own shares in 2000, and spent much of the next decade fending off

takeover attempts by rivals including Nasdaq and Deutsche Boerse

AG.

It has averaged a bid approach every 2 1/2 years since its

initial public offering, according to analysts at Berenberg

Bank.

But while British banks during the 2000s were multiplying in

value from global expansion and increased risk taking, the London

exchange was at threat of becoming obsolete. Its monopoly on

domestic stock trading was ended by a 2007 European Union directive

that paved the way for alternative trading platforms. It suffered

more and its shares slumped as company listings and trading volumes

collapsed after the financial crisis.

Xavier Rolet, who was LSE's chief executive between 2009 and

2017, is credited with reversing the decline and transforming the

company into a global force. He led the acquisition of around 25

companies, including LCH and the FTSE Russell financial indexing

business.

As of June 30, LSE's post-trade services made up 38% of its

GBP1.14 billion ($1.41 billion) in revenue, and information

services made up 39%.

In an interview Thursday, Mr. Rolet said his vision for LSE was

to deepen its role connecting companies, banks and investors

globally, and to let users pay for the products and pieces of

financial plumbing they needed access to, rather than making them

pay for bundled services at a single price.

"We wanted to be one of the two or three financial

infrastructure companies with the full set of products," Mr. Rolet

said. He predicted LSE will eventually have an American or Chinese

owner as the industry continues to consolidate.

His successor, David Schwimmer, set three goals for the group:

to expand globally, become more diversified by asset class and

bolster its data analytics business. In August, Mr. Schwimmer said

the plan to buy Refinitiv, which supplies market information and

operates foreign-exchange and bond trading platforms, addresses all

of those ambitions.

LSE's earlier smart bets made the Refinitiv bid possible, since

it has a strong share price to use as currency, said Chris Turner,

a senior equity analyst at Berenberg. The planned purchase, agreed

with Refinitiv's shareholder Blackstone Group, shot LSE stock up

30%.

"That's the problem for Hong Kong exchange. Now you need to pay

a premium over that premium. It's too expensive now for others,"

Mr. Turner said.

Write to Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

September 13, 2019 12:07 ET (16:07 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

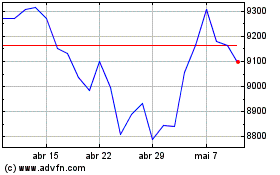

London Stock Exchange (LSE:LSEG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

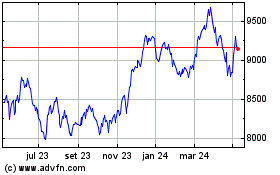

London Stock Exchange (LSE:LSEG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024