Charles Schwab, Lennar, Johnson & Johnson: Stocks That Defined the Week

04 Outubro 2019 - 7:51PM

Dow Jones News

By Francesca Fontana

Charles Schwab Corp.

The race to zero in the money management industry is hitting

bottom. Charles Schwab said Tuesday it would eliminate commissions

on trades made on its mobile and web channels, prompting shares to

fall 9.7%. Rivals such as TD Ameritrade Holding Corp. and E*Trade

Financial Corp. quickly followed suit, intensifying a fierce price

war across the financial sector. Interactive Brokers Group Inc. set

the stage for the moves last week when it said it would launch a

zero-commission stock-trading service.

United States Steel Corp.

A big steelmaker is forging a new partnership. U.S. Steel plans

to acquire a 49.9% stake in its lower-cost rival Big River Steel

for $700 million in cash, with an option to take full ownership

within four years, the company said Tuesday. Big River's technology

and ability to produce sheet steel by melting scrap in an electric

furnace will make U.S. Steel more cost-competitive with rivals such

as Nucor Corp. and Steel Dynamics Inc. Domestic steel prices have

fallen sharply in the past year as manufacturers' demand for steel

waned, making it more difficult for U.S. Steel to make a profit

with its high-cost structure and pushing it to pursue a lower-cost

partner. U.S. Steel shares rose 3.3%.

Johnson & Johnson

Johnson & Johnson said Tuesday it agreed to a $20.4 million

deal to avoid a coming trial accusing the company of helping spark

an opioid-addiction crisis in two Ohio counties. The settlement

makes J&J the fourth drugmaker to reach such a deal ahead of

the trial, which is considered a bellwether for thousands of

opioid-related lawsuits that municipalities and states have filed

against drugmakers. The company said the settlement allows it "to

avoid the resource demands and uncertainty of a trial as it

continues to seek meaningful progress in addressing the nation's

opioid crisis." J&J shares gained 1.6% Wednesday.

Lennar Corp.

Low interest rates are propping up the nation's biggest home

builders. Due to better-than-expected earnings Lennar was among the

best S&P 500 performers during a market rout on Wednesday, with

shares adding 3.8%. The Miami company reported a bigger profit than

analysts anticipated and reported an increase in orders and

deliveries. "We continue to believe the basic underlying housing

market fundamentals of low unemployment, higher wages and low

inventory levels remain favorable," Lennar Chairman Stuart Miller

said in prepared remarks. During the company's earnings call, Mr.

Miller added that lower interest rates have stimulated demand and

improved the affordability of new homes.

Constellation Brands Inc.

Constellation Brands' big bet on cannabis isn't working out. The

Corona brewer swung to a loss in the latest quarter, and its latest

results included roughly $500 million in losses from its investment

in Canadian marijuana grower Canopy Growth Corp. Constellation was

one of the first brewers to invest in cannabis and put roughly $4

billion into Canopy in 2018, giving it a 38% stake in the company.

Constellation's investment lost about $1.3 billion of value in the

latest quarter, including a $839 million decline in Canopy's share

price. Constellation shares lost 6.1% Thursday.

Credit Suisse Group AG

A spy scandal is roiling a Swiss banking giant. Credit Suisse

Chief Operating Officer Pierre-Olivier Bouée resigned after an

internal probe found he ordered the surveillance of the bank's

former wealth-management chief, Iqbal Khan, without discussing it

with Chief Executive Tidjane Thiam or other senior bank officials.

The probe cleared the CEO of any involvement. Credit Suisse also

said it found no evidence Mr. Khan, who started work at rival UBS

Group AG on Tuesday, made any attempt to poach employees or

clients, contrary to suspicions that people close to the bank had

described as underpinning the surveillance. American depositary

shares of Credit Suisse fell 2.7% Tuesday.

HP Inc.

HP may be printing new pink slips. Shares of the computer

hardware maker plummeted 9.6% Friday after the company said it

could eliminate 7,000 to 9,000 jobs from its roughly 55,000

workforce over the next three years. Incoming Chief Executive

Enrique Lores's restructuring plan also aims to revive lagging

printer sales. HP is changing its sales model: The company will

still offer customers the option of buying their discounted

printers, but then will lock them into buying ink from HP as well,

rather than from other, cheaper vendors. Otherwise, they can opt to

purchase printers at a higher price that would allow them to use

third-party ink cartridges.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

October 04, 2019 18:36 ET (22:36 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

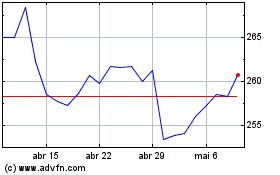

Constellation Brands (NYSE:STZ)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

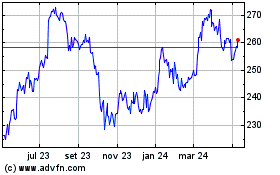

Constellation Brands (NYSE:STZ)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024