By Steven Russolillo and Ben Dummett

Hong Kong's stock exchange pulled a $36.6 billion bid for its

London rival, a deal that would have united two major trading hubs

even as both are clouded in political turmoil.

Less than a month after it first unveiled the surprise proposal,

Hong Kong Exchanges & Clearing Ltd. said it couldn't pursue a

takeover of London Stock Exchange Group PLC without any input from

LSE's management. The target's board had quickly rejected the

approach.

The Hong Kong company had hoped a tie-up would solidify its role

as a gateway for the flow of capital between mainland China and

Western markets. But it said in a statement Tuesday that it was now

"not in the best interests of HKEX shareholders to pursue this

proposal."

Hong Kong is reeling from months of protests over concerns about

China's encroachment on the semiautonomous city. Over the weekend,

the Hong Kong government invoked emergency powers for the first

time in half a century in an attempt to quell the unrest. When LSE

rejected HKEX's offer last month, it questioned Hong Kong's future

as a financial gateway to China.

Britain, meanwhile, is negotiating a messy divorce from the

European Union.

Now, HKEX's challenge is to achieve its ambitions without the

added scale the LSE would have brought against a backdrop of

political unrest, China's economic slowdown and trade tensions that

are threatening the company's appeal as a listing venue.

It also comes as its mainland China rivals move to build their

own links with the West. At the same time, the Shanghai and London

stock exchanges earlier this year launched a financial link between

China and the U.S. that aims to make Chinese shares available to

British investors and vice versa. The London exchange has cited

this agreement among the reasons for rejecting the HKEX bid.

For the LSE, it's now free to conclude its own $14.5 billion

plan to acquire financial-information and terminal company

Refinitiv Holdings Ltd. from a Blackstone Group Inc.-led group to

become a full-fledged data provider. The Hong Kong group's bid was

contingent on its London rival scrapping that transaction. In a

statement Tuesday, the LSE said the Refinitiv deal remains on track

to close in the second half of 2020.

LSE and its rivals are increasingly focusing on selling

financial data to help counteract the pressure on fees from

stock-trading services and other more mature businesses. And that

trend stands to gain further momentum after HKEX's failed LSE bid

serves as the latest example of the challenges global exchange

operators face in seeking cross-border deals with industry

competitors to fuel growth.

The HKEX decision to abandon its LSE offer is also a key

development for Blackstone, which is in line for a big payday if

the Refinitiv deal succeeds. The big U. S-based buyout firm agreed

to acquire the Refinitiv business less than two years ago in a deal

that valued the new firm at $20 billion, including debt. LSE's

offer values the operation at around $27 billion, including

debt.

Two days after HKEX publicly released its proposal on Sept. 11,

the LSE rejected the offer. It said the Refinitiv deal made more

strategic sense and would face a less challenging regulatory

review. LSE and rivals are increasingly focusing on selling

financial data to help counteract the pressure on fees from

stock-trading services and other more mature businesses.

HKEX had sought to create an Asian-European exchange giant

offering trading, clearing, settlement, data and risk-management

services spanning different asset classes, time zones and

continents.

In a blog post on Tuesday, HKEX Chief Executive Charles Li said

the "vision for the business looking forward is to build upon the

role we already play in Hong Kong, China, Asia and more widely."

HKEX declined to make Mr. Li available for further comment.

Shares of HKEX closed 2.3% higher on Tuesday. The stock had

dropped 8.2% from when the proposal was first made public through

the close of trading Friday. The deal was worth $36.6 billion at

the announcement, and about $34.4 billion based on HKEX's closing

share price on Friday and recent exchange rates. Financial markets

in Hong Kong were closed for a public holiday Monday.

LSE shares dropped more than 6% after the bid was rescinded. Yet

the stock remains up more than 70% for the year, with the bulk of

those gains following the Refinitiv deal announcement.

Chinese acquisitions of foreign companies face growing scrutiny

from the Committee on Foreign Investment in the U.S., the U.K., and

other Western governments worried that Beijing could gain access to

sensitive data and financial information.

HKEX had tried to address some of these concerns, noting its

ownership since 2012 of the London Metal Exchange. It said the

primary regulators of LSE's trading, clearing, data and other

operations would continue to oversee those businesses, and the

merged group would maintain a secondary listing in London.

The Hong Kong group could have launched a formal hostile offer,

taking its proposal directly to LSE shareholders. But that would

have been an uphill battle without obvious support for the deal

from HKEX's own shareholders and given the market's positive

reaction to the LSE-Refinitiv tie-up.

Larry Tabb, founder and research chairman of the financial

markets research and advisory firm Tabb Group, said it wasn't

surprising that HKEX pulled the offer, particularly with the

Refinitiv bid already on the table. "It would have been a herculean

effort to get it across the line," he said.

The London Stock Exchange has been involved in a string of

attempted mergers and takeovers over the past two decades. It is

wary of cross-border exchange deals after failing in 2011 to merge

with Canada's TMX Group Ltd. and then in 2017 to join forces with

Germany's Deutsche Börse AG.

--Quentin Webb contributed to this article.

Write to Steven Russolillo at steven.russolillo@wsj.com and Ben

Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

October 08, 2019 06:40 ET (10:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

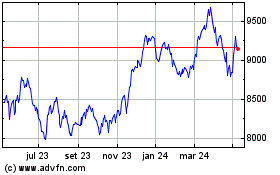

London Stock Exchange (LSE:LSEG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

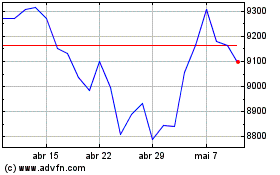

London Stock Exchange (LSE:LSEG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024