Boeing to Cut 787 Production as Earnings Take a Hit -- Update

23 Outubro 2019 - 10:03AM

Dow Jones News

By Doug Cameron

Boeing Co. said its profits more than halved in the latest

quarter and plans to cut production of its 787 Dreamliner jet next

year, but still expects the 737 MAX to return to service by the end

of the year.

The company said slowed production of the MAX will cost an

additional $900 million on top of the $2.7 billion already booked

over the life of the program, though it plans to maintain monthly

output of the 737 range at 42, rising to 57 by the end of next

year.

The update quelled concerns that Boeing would be forced to

freeze MAX production, though it still has to secure approval from

regulators and most operators don't expect the plane to resume

service until early next year.

Its shares rose in premarket trading after sharp falls in recent

sessions.

The MAX crisis has made Boeing more reliant on its larger jets

and defense sales, and the decision to reduce output of the 787

reflects the impact of trade tensions between the U.S. and China,

the company's largest market.

Trade tensions and tariffs have this year slowed the growth in

passengers that's underpinned huge jet orders for Boeing and Airbus

SE over the past decade.

Boeing earlier this year boosted monthly output of the

Dreamliner to 14 from 12, but will reverse that in 2020 for two

years.

Chief Executive Dennis Muilenburg, who's been stripped of his

chairman role because of the MAX crisis, last month warned China

tensions could hit its wide-body business as it had assumed fresh

orders from the country's airlines that have yet to

materialize.

Boeing also has pushed back the planned entry into service of

its larger 777X jetliner into 2021 after problems with its General

Electric Co. engines ruled out a planned first flight this

year.

Boeing on Tuesday ousted the head of its commercial airplanes

unit, the first executive to lose his job over the MAX crisis.

The moves came as Boeing reported a sharp drop in quarterly

earnings, with profits falling to $1.17 billion from $2.63 billion.

Per-share earnings dropped to $2.05 from $4.07 -- ahead of the

$1.92 consensus among analysts polled by FactSet.

Sales fell 21% to $20 billion. Boeing handed over just 63

jetliners in the September quarter compared with 190 in the same

period last year, with analysts estimating it is piled up around

350 undelivered MAX jets, as well as the 380 grounded in March.

The company also announced steps to manage its liquidity after

burning through $2.4 billion in cash over the past three months, on

top of the $1 billion drained in the prior quarter.

Credit-rating firms have put Boeing on watch for a potential

downgrade because of its weakening liquidity.

Boeing has already set aside an initial $5.6 billion to cover

compensation payments to MAX customers, and reached deals with some

carriers. As well as cash payments, Boeing is also offering

discounts on future sales, delivery positions and services.

It hasn't suffered any cancellations because of the MAX crisis,

but slowing traffic growth and airline failures have dented orders

this year.

Boeing boosted its liquidity to $10.9 billion at the end of the

quarter after tapping the debt markets. The $2.4 billion cash drain

in the quarter was much worse than analysts expected, with airlines

withholding payments on jets and suppliers securing better payment

terms. Boeing said its debt levels are 'manageable.'

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

October 23, 2019 08:48 ET (12:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

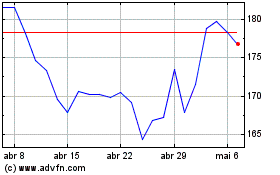

Boeing (NYSE:BA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Boeing (NYSE:BA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024