By Sarah E. Needleman

Streaming video services are in fierce competition for more than

just eyeballs. They also are fighting for software engineers, data

scientists and other tech professionals at a time when joblessness

in the U.S., especially for computer-related work, is historically

low.

Fortune 500 companies such as Apple Inc., Walt Disney Co. and

AT&T Inc., and startups like Quibi Holdings LLC are

aggressively hiring to challenge incumbents Netflix Inc. and Hulu

Inc. Businesses that create and manage streaming apps on behalf of

third parties are also scrambling to hire tech talent.

"If you really understand streaming video, you can kind of write

your own ticket," says Jeremy Legg, technology chief of AT&T's

WarnerMedia, whose streaming properties include HBO Go, HBO Now and

the forthcoming HBO Max. "There is a shortage of these people."

Companies and recruiters say they are racing to find folks to

handle a range of tasks, including building apps, developing

back-end payment systems, analyzing user data, and writing

algorithms for personalized content recommendations.

Yet these firms are competing for workers during one of the

tightest labor markets in decades. The U.S. unemployment rate

dropped to 3.5% in September, the lowest level since December 1969,

according to the Bureau of Labor Statistics. Unemployment in

computer and mathematical occupations -- an indicator of

tech-sector employment -- reached a 20-year low in May at 1.3% and

was 2.4% in September.

Those figures underscore the challenges that employers face in

hiring, says Ryan Sutton, an executive at recruitment firm Robert

Half International Inc. "This is literally the peak of

competitiveness," he says.

Demand for movies and shows at any time online has prompted

companies to rethink how they bundle access to libraries of older

works in addition to new, original programming.

Apple TV+ and Disney+ are launching in November, while Peacock,

a streaming platform being developed by Comcast Corp.'s

NBCUniversal unit, HBO Max and Quibi are set to make their debuts

next year. They're competing against industry leaders Netflix and

Hulu, as well as YouTube, part of Alphabet Inc.'s Google,

Amazon.com Inc.'s Prime Video and others in seeking to stream

entertaining content without any hiccups and in ways that will keep

subscribers hooked.

Netflix's streaming technology, as well as heavy investments in

content, have helped the Los Gatos, Calif., company amass 158.3

million world-wide subscribers, more than double the amount it had

four years ago. Disney-controlled Hulu reported in May that it had

28 million subscribers, up from more than 25 million at the end of

2018 and roughly 17 million at the end of 2017.

To illustrate the complex nature of streaming video,

WarnerMedia's Mr. Legg points to an evening last May when roughly

4.6 million people simultaneously watched the finale of "Game of

Thrones" across more than 20 types of devices ranging from tablets

to big-screen TVs. He nervously watched, hoping that viewers didn't

experience glitches or other problems in the video stream.

"You can generate and build excitement around the programming,

but you have to have tech infrastructure to support a large number

of consumers, " he says. The competition for talent is so stiff,

Mr. Legg says, that WarnerMedia has recruited entire teams of data

scientists and people from outside of entertainment, such as the

airline industry.

Netflix is sometimes filling vacancies in just a matter of days

because so many job candidates have multiple offers in hand, says

Lauren Frank, who oversees tech-related recruiting for the company.

"We can pull out all the stops to move fast," she says. Netflix

currently is looking to fill about 200 tech positions, mostly in

California's Bay Area, she says.

On the hunt for workers, companies lean on employee referrals,

attend job fairs and scour websites like Microsoft Corp.'s LinkedIn

for prospects. Some also work with staffing firms.

Shaun Newsum sees the demand for tech gurus from both sides of

the fence. The 37-year-old software developer is technology chief

at Culture Genesis, a firm he co-founded last year that provides

live, interactive streaming services for media companies. So far he

has hired six people for the Santa Monica, Calif.-based startup by

tapping his personal network. At the same time, he says he has

fielded as many as two to three messages a week from recruiters

using Linke dIn to try to fill streaming positions.

"I've always got people reaching out," says Mr. Newsum, who cut

his teeth in streaming about a decade ago working for MLB Advanced

Media, Major League Baseball's technology arm and an early entrant

in video streaming. "But it's definitely increased a lot more now

that the streaming wars are heating up."

Los Angeles-based Quibi, a larger startup that is developing a

mobile video-streaming platform, has hired roughly 185 people in

the past year, mostly tech professionals, says Meg Whitman, who

leads the firm founded by Hollywood mogul Jeffrey Katzenberg. Ms.

Whitman, who previously was CEO of Hewlett Packard Enterprise Co.

and eBay Inc., says Quibi has about 28 tech openings. Her pitch to

potential recruits: "We offer the chance to join a new company

investing in the future of mobile entertainment."

Hulu, founded in 2007, employs about 900 tech professionals and

has openings for 70 more, says Shannon Sullivan, a senior vice

president who oversees human resources at the Los Angeles-based

company. To appeal to candidates, Ms. Sullivan says Hulu offers

benefits such as help with student-loan debt, extensive parental

leave and child-care support. "Companies have to differentiate

themselves," she says.

Perks that other streaming services are dangling include options

to work remotely and invites to movie and television-show

premieres, executives and recruiters say.

At streaming companies, base salaries for senior tech jobs tend

to be 10% to 15% higher than they are for similar jobs in

industries such as banking and health care, according to David

Perry, an executive recruiter based in Ottawa. "If the service does

well, you can get a great bonus at the end of the year," he

says.

Ms. Needleman is a reporter for The Wall Street Journal in New

York. She can be reached at sarah.needleman@wsj.com.

(END) Dow Jones Newswires

October 23, 2019 10:45 ET (14:45 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

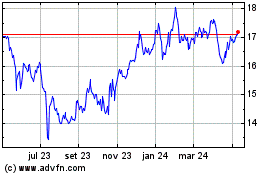

AT&T (NYSE:T)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

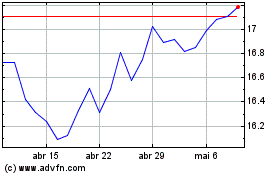

AT&T (NYSE:T)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024