By Chris Matthews, MarketWatch , Andrea Riquier

Microsoft, Ford Motor, Tesla and EBay are due to report earnings

late Wednesday

Stocks edged higher Wednesday despite weaker-than-expected

earnings reports from two Dow components and a poor update from a

semiconductor company, with a fresh wave of corporate results on

deck after the market close.

Wall Street is also watching developments pegged to Brexit,

after a vote for a fast-track exit for Britain from the EU was

rejected by parliament on Tuesday, but the delay eases concerns

about the U.K. crashing out of the bloc without a deal on Oct.

31.

How are major indexes faring?

The Dow Jones Industrial Average rose 27 points, or 0.1%, at

26,814, while the S&P 500 index was 3 points higher at 2,999 a

gain of 0.1%. The Nasdaq Composite Index, picked up 2 points,

hitting 8,107, an increase of less than 0.1%.

On Tuesday

(http://www.marketwatch.com/story/stock-futures-drift-higher-as-one-of-the-busiest-weeks-for-corporate-earnings-unfolds-2019-10-22),

the Dow lost 39.54 points, or 0.2%, to 26,788.10, the S&P 500

index fell 10.73 points, or 0.4%, to 2,995.99, while the Nasdaq

shed 58.69 points, or 0.7%, to 8,104.30.

What's driving the market?

Results from Caterpillar Inc. (CAT) and Boeing Co.(BA) initially

knocked the market lower in pre-market action on Wednesday, but

stocks turned higher in early trading as investors took positives

away from quarterly results from the blue-chip components.

Caterpillar missed both earnings and revenue estimates and cut

its full-year 2019 earnings outlook

(http://www.marketwatch.com/story/caterpillar-cuts-profit-guidance-as-q3-sales-fall-2019-10-23).

Boeing reported a 50% earnings slide that badly missed estimates

and a revenue slide of 20% or less than expected, but also upheld

its forecast for its 737 Max airliner, grounded since March, to

return to service later this year

(http://www.marketwatch.com/articles/boeing-stock-737-max-to-fly-by-year-end-but-profits-will-fall-51571846882).

The poor results from Caterpillar and Boeing, came amid a slide

in the semiconductor sector following a poor forecast from Texas

Instruments Inc. (TXN) in a late-Tuesday earnings report, with a

new revenue estimate range that fell as much as a half-billion

dollars below Wall Street's consensus forecast. That helped drag

the PHLX Semiconductor Index down more than 2%.

See also: Texas Instruments tanks the chip sector and investors'

hopes for a rebound

(http://www.marketwatch.com/story/texas-instruments-tanks-the-chip-sector-and-investors-hopes-for-a-rebound-2019-10-22)

Overall, however, earnings from American companies have been

better than feared, albeit off lowered expectations. Thus far, of

the 98 companies that have reported third-quarter results in the

S&P 500, 82.7% have delivered results above analyst

expectations, while 12.2% reported below analyst expectations,

according to research provider Refinitiv. By comparison, 65% tend

to "beat" estimates, and 20% fall below consensus estimates,

according to Refinitiv data going back to 1994.

Meanwhile, Parliament's rejection of Prime Minister Boris

Johnson's legislative schedule

(http://www.marketwatch.com/story/uks-boris-johnson-inches-toward-securing-brexit-but-with-delays-2019-10-23)for

Brexit reduced the likelihood of a departure by Oct. 31 or a

no-deal exit from the EU. The U.K. government has already asked for

an extension to the end of January 2020, and European Council

President Donald Tusk said on Twitter that he would recommend that

request is granted.

In a light day for U.S. economic data, the Federal Housing

Finance Agency's

(https://www.fhfa.gov/AboutUs/Reports/Pages/House-Price-Index-August-2019.aspx)

house price index for August was 0.2% higher for the month,

bringing annual price gains to 4.6%.

For investors, this week is all about earnings, even with a

Federal Reserve meeting set to kick off in less than a week, said

Randy Frederick, vice president of trading and derivatives at the

Schwab Center for Financial Research. Companies are saying, "How we

did this quarter isn't as important as what we expect the future to

hold," Frederick noted.

The Fed announced earlier this month it will purchase more $60

billion a month in Treasury bills to prevent liquidity crunches

that took place earlier this year and is also expected to cut

interest rates for a third time this year next week.

"Investors have been more concerned about slowing growth, which

is reasonable, but I think there's been an overdose of pessimism

about how resilient consumers are," said Kate Warne, principal

investment strategist with Edward Jones. She pointed out that third

quarter earnings have a tough year-over-year comparison, since last

year corporations got a boost from the late-2017 tax cuts. From

that perspective, results that are slightly better than expected is

solid, the strategist said.

"In an environment of job growth, ultra-low interest rates and

central-bank stimulus, this is actually an okay environment and one

in which you need to be putting money into stocks because they can

continue to go higher," she said.

Which stocks are in focus?

Caterpillar (CAT)cut its full-year 2019 earnings outlook as it

reported third-quarter results that also missed Wall Street's

consensus estimates

(http://www.marketwatch.com/story/caterpillar-cuts-profit-guidance-as-q3-sales-fall-2019-10-23).

Shares were down fractionally.

Boeing (BA) reported a 50% earnings slide that badly missed

estimates and a revenue slide of 20% or less than expected, but

also upheld its forecast for its 737 Max airliner, grounded since

March, to return to service later this year

(http://www.marketwatch.com/articles/boeing-stock-737-max-to-fly-by-year-end-but-profits-will-fall-51571846882).

Texas Instruments(TXN) shares tumbled 6.5% after it reported

earnings per

(http://www.marketwatch.com/story/hilton-worldwide-raises-profit-outlook-2019-10-23)

share of $1.40, excluding certain items, versus the $1.42 analyst

consensus and gave a forecast that was much worse than expected

late Tuesday.

(http://www.marketwatch.com/story/texas-instruments-tanks-the-chip-sector-and-investors-hopes-for-a-rebound-2019-10-22)

Nike Inc. (NKE) shares were down 2.5% after the sports apparel

company late Tuesday reported that longtime CEO Mark Parker was

stepping down, effective January of next year. He will be replaced

by John Donahoe.

Anthem Inc. (ANTM) reported a 23% increase in third-quarter net

income

(http://www.marketwatch.com/story/anthem-tops-forecasts-on-growing-membership-premium-increases-2019-10-23)to

$1.18 billion, or $4.55 a share, as revenue rose 15% to $26.44

billion after increasing medical enrollment by 1.1 million and

increasing premiums. Adjusted for items, Anthem said it would've

earned $4.87 a share. The health-care company's shares were up

about 3.6%.

Shares of Facebook Inc. (FB) will be in focus as CEO Mark

Zuckerberg will testify on the social-media giant's effort to

launch controversial digital-currency platform Libra. Facebook's

stock was up 1.2%.

Hilton Worldwide Holdings Inc. (HLT) revised its financial

targets for the year on Wednesday. The McLean, Va.-based company

said it now expects systemwide revenue per available room, or

RevPAR, to increase about 1% on a currency neutral basis compared

with 2018. The company had previously forecast an increase between

1% and 2%. Shares rose 1.7% on Wednesday.

Waste Management Inc. (WM)said Wednesday

(http://www.marketwatch.com/story/waste-management-profit-tops-estimates-but-sales-miss-as-recycled-commodity-values-slide-2019-10-23)

it had net income of $495 million, or $1.16 a share, in the third

quarter, down from $499 million, or $1.16 a share, in the

year-earlier period. Shares of the company fell 2%.

Chipotle Mexican Grill Inc. shares (CMG)were down 5.6%

(http://www.marketwatch.com/story/chipotle-stock-climbs-after-earnings-beat-2019-10-22)

after the fast-Mexican company on Tuesday reported third-quarter

net income

(http://www.marketwatch.com/story/chipotle-stock-climbs-after-earnings-beat-2019-10-22)

of $98.6 million, or $3.47 a share, compared with $38.2 million, or

$1.36 a share, in the year-ago period. Adjusted for items such as

restaurant asset impairment expense and restructuring, among other

things, earnings were $3.82 a share.

After the market closes Wednesday, EBay Inc.(EBAY), Microsoft

Corp.(MSFT), Ford Motor Co.(F), and Tesla Inc. (TSLA). are due to

report results.

How are other markets performing?

The 10-year Treasury note yield fell to 1.746% on Wednesday from

1.768% late Tuesday in New York. The mixed corporate outlook has

investors favoring bonds as they wait out the results still due

this week. In Europe, eyes are on Brussels, where an EU agreement

to delay Brexit may lead to U.K. Prime Minister Boris Johnson

seeking an early election.

Oil futures turned higher on Wednesday

(http://www.marketwatch.com/story/oil-futures-fall-1-ahead-of-eia-inventory-report-2019-10-23)

after a U.S. government report showed a decline in U.S. crude

supplies for the first time in six weeks. December WTI crude , on

its first full session as a front-month contract, rose 72 cents, or

1.3%, at $55.21 a barrel on the New York Mercantile Exchange.

Prices were likely to mark their highest settlement so far this

month.

Gold prices enjoyed a fillip from haven buying on Wednesday

(http://www.marketwatch.com/story/gold-attempts-to-halt-3-session-slide-and-creeps-back-toward-1500-2019-10-23)

as a retreat in assets considered risky, amid political

uncertainties like Brexit, underpinned gains in the yellow metal.

Gold gained for a second day. Gold for December delivery on Comex

gained $9.20, or 0.6%, to trade at $1,496.70 an ounce, after

trading little changed on Tuesday.

The ICE U.S. Dollar Index , which tracks the performance of the

greenback against six major rivals, rose less than 0.1% to

97.57.

Elsewhere, the Stoxx Europe 600 closed 0.1% at 395.03. In Asia,

China's CSI 300 index finished off 0.6% at 3,871.08 and the

Shanghai Composite Index slipped 0.4% to 2,941.62, while Hong

Kong's Hang Seng Index fell 0.8% to reach 26,566.73. Japan's Nikkei

225 gained 0.3% to 22,625.38.

(END) Dow Jones Newswires

October 23, 2019 12:38 ET (16:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

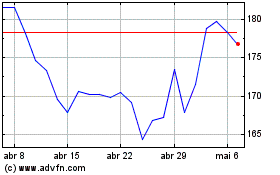

Boeing (NYSE:BA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Boeing (NYSE:BA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024