Royal Bank of Scotland Swings to 3Q Pretax Loss After Higher PPI Costs

24 Outubro 2019 - 4:01AM

Dow Jones News

By Sabela Ojea

Royal Bank of Scotland Group PLC (RBS.LN) on Thursday reported a

swing to a pretax loss for the third-quarter after booking extra

PPI costs following a late surge in claims ahead of the August

deadline, as previously guided.

The majority-state-owned bank booked a 900 million pound ($1.16

billion) provision to cover payment protection insurance costs. It

said in September that the bank expected to book a provision of

GBP600 million to GBP900 million.

The London-listed lender made an pretax loss of GBP8 million for

the quarter ended Sept. 30, compared with a profit of GBP961

million in the year-earlier period, after returning to

profitability in 2017.

RBS's net loss came to GBP315 million, compared with a profit of

GBP448 million a year earlier.

Total income for the quarter fell to GBP2.90 billion from

GBP3.64 billion in the year-earlier quarter.

Net interest income fell to GBP2.01 billion from GBP2.15 billion

a year earlier. RBS said its net interest margin, the difference

between the money it earns on lending and pay out on funding,

decreased by seven basis points compared with the second

quarter.

RBS ended the quarter with a common equity Tier 1 ratio--a key

measure of balance-sheet strength--of 15.7%, which included a 50

basis point reduction in respect of the PPI charge.

The bank also reaffirmed its previous outlook guidance for the

full year, with revenues forecast to be GBP12.31 billion, taken

from FactSet and based on 15 analysts' estimates.

Write to Sabela Ojea at sabela.ojea@wsj.com; @sabelaojeaguix

(END) Dow Jones Newswires

October 24, 2019 02:46 ET (06:46 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

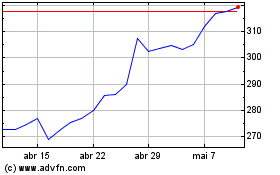

Natwest (LSE:NWG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

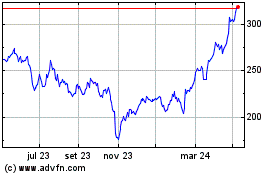

Natwest (LSE:NWG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024