Ford Cites Drag From China, Discounts -- WSJ

24 Outubro 2019 - 4:02AM

Dow Jones News

By Ben Foldy

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 24, 2019).

Ford Motor Co.'s operating profit rose 7.5% in the third quarter

but the auto maker lowered its target for the full year, marking a

setback for CEO Jim Hackett's bid to revive long-term earnings

growth through a broad restructuring.

Ford shares fell about 3% in aftermarket trading following the

report.

The auto maker's dimmer outlook came despite quarterly results

that surpassed analysts' estimates. Ford's operating profit of $1.8

billion for the July-to-September period was buoyed by higher sales

in North America and strength in the company's lending arm.

Looking ahead, the company said the cost of warranty repairs,

weakness in China and tougher competition in trucks and

sport-utility vehicles in North America will prevent its 2019

earnings from hitting a range set in July.

Ford now expects operating income of $6.5 billion to $7 billion

for the full year, compared with its previous projection of $7

billion to $7.5 billion.

Mr. Hackett has told investors that an overseas restructuring

and a redesigned vehicle-development process initiated last year

will start showing results this year. The company is also winnowing

its vehicle portfolio to focus on more-profitable lines, such as

trucks and SUVs in the U.S. and commercial vehicles in Europe.

Finance chief Tim Stone said Wednesday that Ford is having to

spend more on discounts and other incentives for customers as

competition in trucks and SUVs in North America -- the company's

most lucrative market -- is intensifying. He also cited warranty

costs and slumping sales in China, a once-booming market that in

recent years has become a money loser for Ford.

The Dearborn, Mich., car company has struggled with the rollout

of a new Explorer SUV that executives were counting on to boost

second-half earnings. Ford said Explorer sales were down 48% in the

third quarter, a drop it attributed to difficulty overhauling its

Chicago factory to produce the new model. The company's SUV sales

overall fell nearly 11%.

"That was a very challenging launch for us," Mr. Stone said,

adding that output of the SUV is approaching desired levels.

Net income for the third quarter sank to $425 million, from $991

million in the same period last year. The company attributed the

decline to one-time charges for its global restructuring efforts,

including about $800 million in costs related to its joint venture

in India with Mahindra & Mahindra Ltd.

Third-quarter revenue eased to $37 billion from $37.6 billion a

year earlier.

The auto maker's earnings per share, adjusted for one-time

items, registered at 34 cents, beating Wall Street analysts'

average forecast of 26 cents.

Ford narrowed its losses in China to $281 million, from $378

million in last year's third quarter. The company has pared costs

in the world's largest car market, but its sales continued to

decline amid a market downturn that has lasted longer than many

executives and analysts expected.

In North America, where the company has leaned heavily on its

truck business to drive profit, Ford earned just over $2 billion

for the period, up 3% from a year earlier. But its margins on the

continent declined to 8.6% from 8.8%, as the company spent more to

compete with newer pickup truck offerings from General Motors Co.

and Fiat Chrysler Automobiles NV.

Ford trimmed its losses in Europe, as it cut costs and shifted

its focus to commercial vehicles like vans. The auto maker laid out

plans this summer to close six factories in Europe and eliminate

12,000 jobs in hopes of turning a profit in the region.

While warranty costs are rising for older vehicles, improved

quality control should lower such expense in coming years, Mr.

Stone said.

--Mike Colias contributed to this article.

Write to Ben Foldy at Ben.Foldy@wsj.com

(END) Dow Jones Newswires

October 24, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

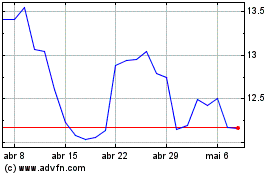

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

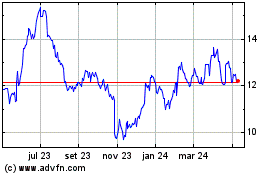

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024