American Airlines Lowers Earnings Guidance

24 Outubro 2019 - 9:29AM

Dow Jones News

By Patrick Thomas

American Airlines Group Inc. said Thursday that the continued

grounding of Boeing Co.'s 737 MAX airplanes and other operational

challenges from labor contract negotiations weighed on its results

and annual outlook.

The carrier said it now expects the MAX cancellations will hurt

its full-year pretax income by about $540 million. American's 24

Boeing 737 MAX jets have been grounded since March, crimping its

growth plans.

The company lowered the high-end of its full-year adjusted

earnings guidance to $5.50 a share from $6 a share. The low-end of

the range is $4.50 a share.

The Fort Worth, Texas, carrier reported a profit of $425

million, or 96 cents a share, compared with $372 million, or 81

cents a share, a year ago.

The company reported adjusted earnings of $1.42 a share.

Analysts polled by FactSet were expecting earnings of $1.33 a

share, or $1.40 a share on an adjusted basis.

Revenue rose to $11.91 billion from $11.56 billion a year

earlier, driven by stronger passenger demand. Analysts had expected

$11.94 billion of revenue in the quarter.

"We know that our results should have been better," Chief

Executive Doug Parker said in a statement. "Our third quarter was

impacted by the continued grounding of the Boeing 737 MAX and the

operational challenges resulting from ongoing labor contract

negotiations.""

Shares of the company were off 1% during premarket trading.

The airline reshuffled some executives earlier this month as it

faces operational issues that has hurt its reputation and weighed

on shares in recent months.

Write to Patrick Thomas at Patrick.Thomas@wsj.com

(END) Dow Jones Newswires

October 24, 2019 08:14 ET (12:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

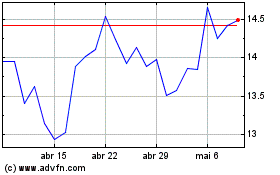

American Airlines (NASDAQ:AAL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

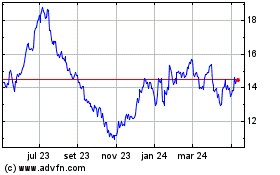

American Airlines (NASDAQ:AAL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024