American, Southwest Under Pressure from 737 MAX Grounding --Update

24 Outubro 2019 - 10:55AM

Dow Jones News

By Patrick Thomas

Two major airlines said on Thursday that they are facing a

rising price tag from higher costs and lost revenue as the

grounding of the Boeing Co. 737 MAX stretches into its eighth

month.

Southwest Airlines Co. said the grounding reduced its operating

income by $435 million in the first nine months of the year and by

$210 million in the third quarter. The airline expects the impact

to spill into 2020.

American Airlines Group Inc., which also reported third-quarter

results, said it expects the grounding to drag down its full-year

pretax profits by $540 million, up from the $400 million impact it

previously anticipated.

Both airlines said strong demand for travel helped boost

revenues during the quarter, even though they have had to curtail

growth plans. Gary Kelly, Southwest's CEO, said bookings are

healthy, bolstering the carrier's outlook even though the airline

won't be able to fly as much as it planned to during the coming

holiday season.

American's revenue grew 3% during the quarter. But the airline

lowered the high-end of its full-year adjusted-earnings guidance to

$5.50 a share from $6 a share. The low-end of the range is $4.50 a

share.

"We know that our results should have been better," Chief

Executive Doug Parker said in a statement, citing the MAX grounding

and a dispute with mechanics that the airline said scrambled

operations over the summer.

The MAX has been grounded globally since March following a

second fatal crash in less than five months, forcing airlines to

cancel thousands of flights and miss out on the revenue they would

have brought in.

Southwest is the biggest MAX customer, with 34 in its fleet and

41 that were due to arrive this year. American had 24 MAX jets at

the time of the grounding.

Airlines that fly the MAX have spent much of the year waiting

for Boeing to make software fixes and for regulators to sign off.

The plane's expected return has slipped several times, with each

delay requiring carriers to cancel flights and rebuild

schedules.

The past week has been particularly tumultuous, with lawmakers

and regulators raising fresh concerns about how the MAX was

developed and certified. Some worried that the disclosure of a

former Boeing pilot's internal messages, suggesting he had

encountered trouble during tests in a simulator in 2016 and had

unknowingly misled regulators in his work on the MAX, could derail

progress toward the plane's return to service.

Boeing on Wednesday said that it still believes it can secure

regulatory approval for the return of the MAX this year. Airlines

say it may take another month or two to work through training and

prepare stored planes to fly, and the carriers aren't taking their

chances with holiday travel schedules. American and United Airlines

Holdings, which also flies the MAX, have removed the plane from

their schedules until January, while Southwest has taken it out

until February.

For travelers, the grounding has meant fewer flight options and

other inconveniences, like changes to long-planned trips as the

MAX's return date has been pushed out. American and Southwest have

both said the grounding has contributed to a rise in denied

boardings as they have been forced to accommodate passengers on a

smaller number of planes.

Some analysts have said the absence of the MAX likely resulted

in fares that were higher than they otherwise would have been.

Mr. Kelly said Southwest is negotiating with Boeing for

compensation, but hasn't reached a settlement. Boeing took a $5.6

billion charge earlier this year to cover potential payments to

customers, which could include discounts and services, as well as

cash payments.

Investors have started to become anxious that whenever the MAX

does return to service, it will result in a flood of new capacity

hitting the market as demand for travel starts to slow. At the same

time, airlines' costs are poised to climb due to new labor deals

being worked out.

American has also faced disruption from strife with the unions

that represent its mechanics, alleging in a lawsuit that the union

is encouraging a work slowdown that is wreaking havoc on its

operation and leading to hundreds of canceled flights. Union

leaders have denied that they are encouraging a coordinated

slowdown, but American has said the situation has started to

improve since a federal judge in August ordered the unions to

resume normal work levels. The two sides have returned to the

negotiating table and American said its operation has started to

improve.

Southwest posted earnings of $659 million, or $1.23 a share, up

from $615 million, or $1.08 a share in the comparable quarter last

year. Analysts polled by FactSet were expecting $1.09 a share.

American reported a profit of $425 million, or 96 cents a share,

up from $372 million, or 81 cents a share a year earlier. Adjusted

earnings were $1.42 a share, ahead of the $1.40 a share analysts

were expecting.

--Patrick Thomas and Dave Sebastian contributed to this

article.

Write to Patrick Thomas at Patrick.Thomas@wsj.com

(END) Dow Jones Newswires

October 24, 2019 09:40 ET (13:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

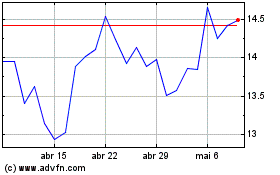

American Airlines (NASDAQ:AAL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

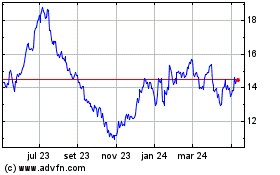

American Airlines (NASDAQ:AAL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024