Stocks End Day Flat As Cisco Weighs on Market

14 Novembro 2019 - 7:05PM

Dow Jones News

By Michael Wursthorn and Caitlin Ostroff

The S&P 500 eked out a small gain Thursday to close at a

fresh record following a tepid session of trading.

The broad index rose in the final hour of trading as shares of

real-estate companies and material firms notched gains along with

communication and consumer-discretionary stocks.

That helped overcome a steep decline in shares of Cisco Systems,

which weighed on the stock market throughout Thursday's session and

kept the Dow Jones Industrial Average and the Nasdaq Composite in

the red.

Analysts blamed the tepid trading session on fresh signs of

doubt around the U.S.'s ability to clinch the first part of a trade

truce with China later this year. The Wall Street Journal reported

Wednesday that U.S. and China continue to haggle over agriculture

purchases, giving investors little enthusiasm to broadly buy

riskier assets.

While stocks were listless throughout most of the session,

assets considered to be safe stores of value notched bigger moves.

Gold rose 0.6%, while the yield on the yield on the benchmark

10-year U.S. Treasury note fell a third straight day. Prices rise

as yields fall.

"Investors need to see something that they're comfortable with

on the trade front," said Mike Bailey, director of research at FBB

Capital Partners. Until then, "It's a 'hold your breath' type of

market," he added.

Investors will continue to monitor the U.S.-China trade

situation, analysts said, as well as the latest economic figures

due Friday on retail sales and industrial production.

The S&P 500 rose 2.59 points, or less than 0.1%, to 3096.63

Thursday. The Dow industrials, meanwhile, fell 1.63 points, or less

than 0.1%, to 27781.96, and the Nasdaq Composite declined 3.08

points, or less than 0.1%, to 8479.02.

All three indexes were hampered by Cisco's $3.55, or 7.3%,

pullback to $44.91, its biggest drawdown in roughly three months,

after the company said late Wednesday that it expects to book its

first quarterly revenue decline in more than two years. The

networking giant, considered a proxy for corporate high-tech

hardware demand, blamed lighter customer spending for the

lackluster outlook.

"We're painfully aware of the situation" with Cisco, Mr. Bailey

said. Despite Cisco's bellwether status, the company's problems

appear to be restricted to itself, he added.

Technology stocks in the S&P 500 fell 0.1%, as shares of

several other communications equipment companies declined along

with some semiconductor stocks. Kraft Heinz also slid $1.94, or

5.9%, to $30.96 after Goldman Sachs cut its rating on the food

company.

Real estate and material stocks rallied 0.8% and 0.5%,

respectively, by the session's end, helping the S&P 500

overcome Cisco's weakness. Shares of communication, consumer

discretionary and industrial companies also rose, giving the broad

index some support.

Elsewhere, the Stoxx Europe 600 fell 0.4%, led by declines in

auto makers.

Asian stocks, meanwhile, were mixed, with the Shanghai Composite

up 0.2%, while Hong Kong's Hang Seng waned 0.9% as antigovernment

protests snarled the city.

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com and

Caitlin Ostroff at caitlin.ostroff@wsj.com

(END) Dow Jones Newswires

November 14, 2019 16:50 ET (21:50 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

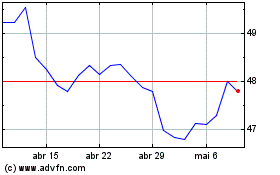

Cisco Systems (NASDAQ:CSCO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

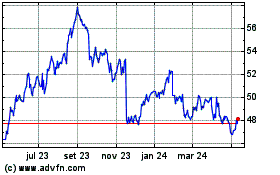

Cisco Systems (NASDAQ:CSCO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024