FedEx Closes Pension Plan to New Hires

18 Novembro 2019 - 6:58PM

Dow Jones News

By Paul Ziobro

FedEx Corp. is closing its pension plan to new U.S. hires

starting next year, joining the ranks of large U.S. companies

phasing out guaranteed retirement benefits.

The shipping giant instead will launch a new 401(k) plan at the

start of 2021 with a higher company match. Under the new plan,

FedEx will contribute up to 8% of employee salaries, if employees

contribute 6% of their salary.

FedEx is part of a shrinking group of U.S. companies still

allowing employees to accrue traditional pension payments. Its

chief rival, United Parcel Service Inc., closed its pension plan to

new workers in 2016, and FedEx said in a memo to employees Monday

that just 22% of Fortune 50 companies and 11% of transportation

companies offer pensions to new hires.

"As we continue to evolve FedEx retirement benefits to remain

competitive, we recognize that more and more people understand the

value of a 401(k) structure," FedEx human resources executive Judy

Edge said in the memo.

New hires will be eligible to participate in the current 401(k)

plan, which matches up to 3.5% of salaries, until the new plan

launches. Existing workers will have the option of continuing under

the pension plan and existing 401(k) or transition to the 401(k)

plan with the higher match.

FedEx said that the changes were made to give employees more

control over their savings and that 401(k) plans with higher

matches make the company more competitive.

The majority of the 100 largest corporate pension plan sponsors

have implemented some sort of freeze, meaning that either existing

employees aren't accruing benefits or the plans are closed to new

employees, said Zorast Wadia, principal and consulting actuary with

Milliman. Less than half allow new employees to enroll in

defined-benefit plans, Mr. Wadia said.

A year after closing its pension to new hires, UPS in 2017 said

it would freeze pension plans for 70,000 of its nonunion workers

beginning in 2023, meaning they no longer accrue additional

benefits for future service. The company will instead make

contributions to employee 401(k) accounts.

FedEx in May 2018 said it reached a deal with MetLife Inc. under

which the insurer would take responsibility for about $6 billion of

pension payments to about 41,000 retirees and beneficiaries.

FedEx had a pension deficit of nearly $4 billion and obligations

of $28.9 billion at the end of its fiscal year ended May 31,

2019.

--Heather Gillers contributed to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

November 18, 2019 16:43 ET (21:43 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

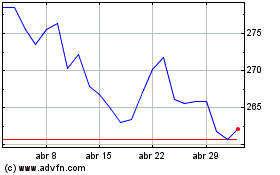

FedEx (NYSE:FDX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

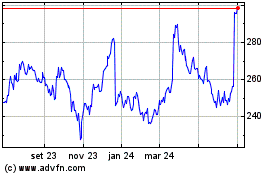

FedEx (NYSE:FDX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024