Glencore Signals 2020 Management Turnover

03 Dezembro 2019 - 3:48PM

Dow Jones News

By Alistair MacDonald

Mining giant Glencore PLC signaled a management reshuffle next

year that would pave the way for the retirement of its high-profile

chief executive officer, Ivan Glasenberg.

Updating investors on future strategy, Mr. Glasenberg said the

company would meet in early 2020 to talk about a change in its "old

guard." Once a new layer of management is in place, Mr. Glasenberg

said he would be in a position to step aside.

"The old guys will be leaving," he said on a conference call. "I

don't want to be an old guy running this company -- and soon as

those guys are ready to take over, I will move aside."

Mr. Glasenberg, who joined Glencore in 1984 and has been CEO

since 2002, said last year that he would step aside within two to

five years. The South Africa-born executive, 62 years old, is one

of just a handful of senior staff who were with the company when it

was floated on public markets in 2011.

The chief executive merged Glencore, a commodities-trading

company, with Xstrata, one of the world's biggest mining companies,

in a $29.5 billion deal that created one of the world's largest

coal, copper and zinc producers in 2013.

In recent years, the company has replaced the heads of its

copper and oil divisions.

Glencore's share price this year has suffered from increased

legal and regulatory scrutiny of its businesses, the group's large

exposure to coal, weak copper and cobalt prices, and other factors.

Glencore said in July 2018 that it had received a subpoena from the

U.S. Justice Department, demanding records related to its

compliance with American antibribery and money-laundering laws in

Congo, Nigeria and Venezuela.

Glencore has also said that it is the subject of an

investigation by the U.S. Commodity Futures Trading Commission.

The company has engaged external legal counsel and forensic

experts to assist in responding to the DOJ and CFTC investigations,

Glencore said in its half-year results in August.

The company on Tuesday said it was well positioned for growth

trends such as increased use of electric-powered transport, given

its exposure to resources that are used to make their engines and

batteries. But Mr. Glasenberg also reiterated the company's

commitment to its large coal business, at a time that investors are

increasingly turning away from the fuel over environmental

concerns.

Mr. Glasenberg, who once led the company's coal division, said

that while coal's share of global energy generation will fall, the

actual demand for coal will increase as new power stations come on

line in Asia.

"Right now coal is there, it generates a lot of [earnings] for

the company," he said.

Write to Alistair MacDonald at alistair.macdonald@wsj.com

(END) Dow Jones Newswires

December 03, 2019 13:33 ET (18:33 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

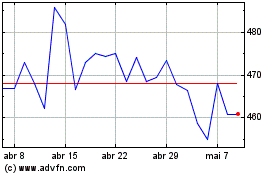

Glencore (LSE:GLEN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

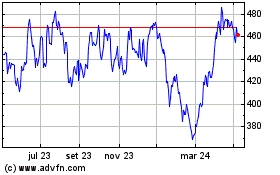

Glencore (LSE:GLEN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024