By Esther Fung

With the booming growth of online grocery sales and rising

consumer demand for fresh produce, property investors are trying to

cash in on the places where grocers and delivery companies store

all their food.

Customers of these cold storage warehouses are some of the

biggest names in the food business, from manufacturers like Tysons

Food Inc. to grocery chains such as Kroger Co. and big food sellers

like Walmart Inc. Online grocers like Peapod also use

temperature-controlled spaces.

Now--similar to the way real-estate investors flocked to

distribution centers to profit from the rise of online

shopping--investors are starting to pile into cold storage

warehouses. Analysts say it is a business poised for rapid growth

but one that involves more risks than owning other real estate,

including typical industrial warehouses that hold books, mobile

phones or sweaters.

During the first three quarters this year, investors bought $1.9

billion worth of refrigerated warehouses--up from $1.77 billion for

all of 2018--and higher than any year in the past decade, according

to data firm Real Capital Analytics.

While there are hundreds of companies that own refrigerated

warehouses in the U.S., the sector is consolidating as the biggest

players buy up smaller competitors. Just two firms--Lineage

Logistics LLC and Americold Realty Trust--control 63% of the cold

storage warehouses held by the top 25 owners in North America,

according to the International Association of Refrigerated

Warehouses.

Last month, Americold said it would acquire Canada-based Nova

Cold Logistics, which owns three locations, for 337 million

Canadian dollars ($253 million). It also completed the purchase of

two facilities in Maryland and Pennsylvania.

Shares of Americold, the only publicly-listed real-estate

investment trust focused on cold storage, have been on a tear. The

stock's total returns are up 46% this year, compared to the broader

MSCI U.S. Reit Index, which rose 26%.

Having a big portfolio shields the firm from fluctuations in the

agriculture or seafood businesses, said Fred Boehler, chief

executive officer of Americold.

"Whether there is a bad harvest or cattle shortages, we as

consumers, are still going to eat," he said. "If beef is down,

you're going to eat chicken or pork."

The push for more cold storage is also going global. Lineage,

the world's largest refrigerated storage company by storage

capacity, last month said it said it would pay more than $900

million to acquire Emergent Cold in a move to expand in Asia.

Lineage bought rival Preferred Freezer Services LLC for more than

$1 billion earlier this year.

"Cold-storage used to be a cottage industry where a company

would own three or four buildings," said Greg Lehmkul, Lineage's

CEO, in an interview with The Wall Street Journal last month.

Despite shifting consumer tastes toward fresher foods and

delivery convenience, the business of storing food comes with

plenty of risks that owners of distribution centers for

non-perishables don't face.

In the 1990s, real-estate companies like Vornado Realty Trust

and Crescent Real Estate Equities Co. suffered from

greater-than-expected capital and labor costs associated with cold

storage and exited the business in the 2000s.

Operators of cold storage facilities generally have to hire more

staff to manage the facilities and handle services like packing and

unpacking food for distribution.

Americold experienced an increase in health care claims related

to health care claims from employees, which reached $13 million in

the third quarter. Analysts from SunTrust Robinson Humphrey have

said they would have to "think more cautiously about longer-term

labor expense estimates," at Americold following its latest

earnings report.

This resulted in a reduced guidance of its annual net operating

income growth to the "bottom half" of a 3% to 6% estimate.

The company said investors should focus on annual rather than

quarterly results, which can be bumpy.

Cold-storage warehouses can also cost three times more to build

than those for dry goods, according to real-estate firm CBRE Group

Inc. The facilities have freezing and preservation equipment.

Operators often require specialized knowledge about food

distribution and storage. Some foods need to be frozen gradually

and operators have to prevent temperatures from fluctuating too

much when doors are opened.

When you leave your refrigerator door at home open for too long,

the temperature could rise by 5 degrees. "We can't allow that to

happen," said Mr. Boehler, adding that his facilities have "high

speed doors."

Still, returns for cold storage have been outperforming those of

dry warehouses, as indicated by capitalization rates, a measure of

a property's annual income as a percentage of its price. Lower cap

rates means higher values, and the gap between cold-storage and

dry-storage warehouses have narrowed to 0.75 percentage point from

2 percentage points over the past three years, CBRE said.

Jennifer Smith contributed to this article.

Write to Esther Fung at esther.fung@wsj.com

(END) Dow Jones Newswires

December 10, 2019 07:14 ET (12:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

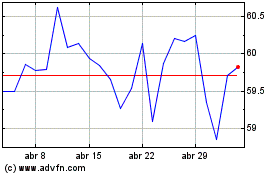

Walmart (NYSE:WMT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

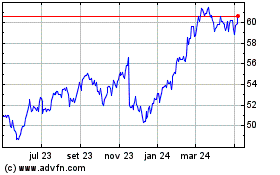

Walmart (NYSE:WMT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024