Ford Vehicle Sales Declined 3.2% in 2019 -- Update

06 Janeiro 2020 - 2:24PM

Dow Jones News

By Dave Sebastian and Mike Colias

Ford Motor Co. said its U.S. vehicle sales were off 3.2% in 2019

as falling sport-utility vehicle and sedan sales outweighed gains

in purchases of trucks, the latest U.S. auto maker to report

declining sales.

The No. 2 U.S. auto maker by sales said Monday it sold about

2.41 million vehicles last year, down from around 2.49 million in

2018. For the last three months of 2019, sales were off 1.3% to

598,728 units.

Ford was the final auto maker to post its 2019 sales, following

results reported Friday from most of the industry. Overall, U.S.

vehicle sales fell 1.6% last year, to 17.1 million vehicles,

research site Edmunds.com said Monday. It marked an unprecedented

fifth straight year the industry topped that amount.

Sales of trucks rose 8.8% to about 1.24 million in 2019 and 16%

to 326,941 for the fourth quarter. The company said it sold 153,868

Transit vans last year, up 12% from the prior year.

Car sales fell 28% to 349,091 units for the full year,

reflecting Ford's decision to drop nearly all passenger cars from

its U.S. lineup. SUV sales were off 4.8% to 830,471 units.

Mustang sales fell 4.4% to 72,489 units. In November, Ford

unveiled an all-electric SUV that will be called the Mustang Mach-E

and wear the galloping pony logo in a move to spark the auto

maker's transition to an electric future.

Ford is relying more on the U.S. market to drive results amid a

steep falloff of sales in China. The company is also narrowing its

focus in Europe and Latin America, exiting some car categories to

focus on truck and van sales.

Sales of Ford's top-selling vehicle and biggest moneymaker --

its F-150 Series pickup trucks -- slipped 1.4% in 2019.

Ford and General Motors Co. are fending off Fiat Chrysler

Automobiles NV's surging Ram truck brand. Sales of the Ram pickup

truck -- which was sold under the Dodge name until a decade ago --

rose 18% last year to 633,694 vehicles, overtaking GM's Chevy

Silverado for the first time. Silverado sales fell 2.5%, to

570,639.

U.S. vehicle sales rose steadily since the financial crisis a

decade ago, when they bottomed out at 10.4 million in 2009. Sales

hit a record 17.6 million in 2016 and have bobbed along around the

17-million mark in recent years, providing an unusually steady

environment for an industry accustomed to cyclical swings.

GM on Friday reported a 2019 sales decline of 2.3%, dented

largely by last fall's 40-day United Auto Workers strike that

brought more than 30 U.S. factories to a standstill and depleted

dealerships' new-vehicle inventories, the company said Friday. The

Detroit auto maker said its fourth-quarter sales fell 6% over the

prior-year period.

Trade tensions have eased since last year's U.S.-China clash

over auto tariffs and an amended North American trade pact remained

unsettled. Ford, GM, Volkswagen AG and other auto giants last year

embarked on restructurings that included tens of thousands of

layoffs and factory closings as earnings came under pressure.

On Friday, Fiat Chrysler said sales in the U.S. fell 1% last

year, while Toyota Motor Corp. reported a nearly 2% decline in U.S.

sales. Honda Motor Co. last week reported flat 2019 U.S. sales,

while Nissan Motor Co. said sales fell nearly 10%.

Electric-vehicle maker Tesla Inc., meanwhile, said deliveries

rose 50% in 2019 to 367,500.

The industry faces potential headwinds in the U.S. in 2020. Car

dealers grappled with unusually large stockpiles of unsold vehicles

for much of last year and struggled to off-load older models,

forcing steeper discounts. Auto makers are spending more to lure

buyers, potentially heralding weaker demand and slower sales ahead,

analysts say. The industry's spending on sales incentives in recent

months hovered around 11% of a car's sticker price, the highest

level since 2008, according to J.D. Power.

Write to Dave Sebastian at dave.sebastian@wsj.com and Mike

Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

January 06, 2020 12:09 ET (17:09 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

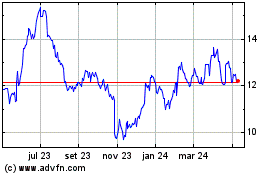

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

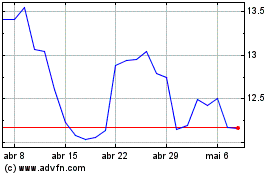

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024