Rio Tinto Sees Iron-Ore Shipments Rebounding in 2020 -- Update

16 Janeiro 2020 - 7:21PM

Dow Jones News

By David Winning

SYDNEY--Rio Tinto PLC (RIO.LN) forecast improved iron-ore

shipments from its Australian mining hub this year after

operational and weather-related setbacks curbed output in 2019.

The miner, one of the world's top exporters of the steel

ingredient, expects to ship between 330 million and 343 million

metric tons of iron ore in 2020. That would represent an increase

on the 327.4 million tons shipped in 2019, after reporting

fourth-quarter movements of 86.8 million tons on Friday.

Rio Tinto has benefited from high iron-ore prices over the past

year, while experiencing operational and weather-related issues

that meant it wasn't able to capitalize fully on the tailwind

behind its most profitable division. The company in June lowered

its 2019 production target from up to 343 million tons on setbacks

at the Greater Brockman hub especially prompted a review of mine

plans. Earlier in the year, Rio Tinto grappled with disruptions

from a cyclone and a fire at a key port.

Iron ore prices remain above US$90 a ton, up roughly one-quarter

on what it fetched at the start of 2019. Recent rains in Brazil

have constrained supply there while a tropical cyclone bore down on

iron-ore ports in Western Australia before passing by to the north.

China's phase-one trade deal with the U.S. may support demand for

iron ore, although mills there look to have largely restocked ahead

of the lunar new year period, analysts say.

"We finished the year with good momentum, particularly in our

Pilbara iron ore operations and in bauxite," said Chief Executive

Jean-Sebastian Jacques. "We are increasing our investment, with

US$2.25 billion of high-return projects in iron ore and copper

approved in the fourth quarter."

Rio Tinto expects to produce between 55 million tons and 58

million tons of bauxite this year, building on output of 55.1

million tons in 2019. It also forecast alumina output of 7.8

million-8.2 million tons, up from 7.7 million tons in 2019.

Among its other commodities, the miner projected a fall in mined

copper production to 530,000-570,000 tons this year from 577,400

tons in 2019. That guidance reflects lower grades at its Kennecott

mine in Utah, although it sees grades becoming more consistent

later in the year.

"Our guidance is framed by expectations of general stability in

global GDP growth in 2020, tempered by negative risks, including

geopolitical tensions and oil price volatility," Rio Tinto said.

"In this environment, we will continue to monitor and adjust

production levels and product mix to meet customer requirements in

2020, in line with our value over volume strategy."

-Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

January 16, 2020 17:06 ET (22:06 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

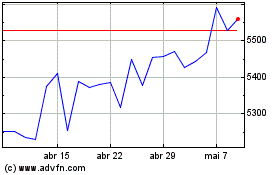

Rio Tinto (LSE:RIO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

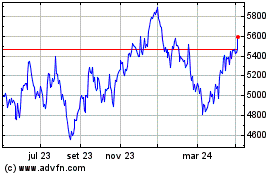

Rio Tinto (LSE:RIO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024