American Airlines, Starbucks, Netflix: Stocks That Defined the Week

24 Janeiro 2020 - 9:18PM

Dow Jones News

By Francesca Fontana

American Airlines Group Inc.

Worries about a mysterious pneumonia-like virus are circulating

through the airline industry as more people in China choose not to

travel. Typically hundreds of millions visit family or take a

vacation during the Lunar New Year holiday. This year many are

staying closer to home due to the coronavirus, part of a class of

pathogens that cause a range of respiratory illness. The number of

confirmed cases of coronavirus tripled Monday and accelerated

through the week. Shares of American Airlines fell 4.2%

Tuesday.

Starbucks Corp.

First Starbucks tossed its plastic straws. Now it wants to cut

its water use and the amount of trash it sends to landfills over

the next decade, the latest big company to set fresh targets for

limiting its environmental impact. Starbucks said Tuesday it will

aim to serve more coffee in reusable cups, curb food and packaging

waste and set a more environmentally friendly menu. New stores will

make more efficient use of energy and water, and the company plans

to improve environmental practices among its coffee growers and

other suppliers. Shares fell 1.2% Tuesday.

Uber Technologies Inc.

Uber might give drivers the green light to set their fares.

Drivers who ferry passengers from airports in Santa Barbara, Palm

Springs and Sacramento can charge up to five times the fare Uber

sets on a ride, a test that began Tuesday. The experiment is part

of Uber's effort to strengthen its case that its drivers operate

with some degree of independence. Earlier this month, Uber capped

its commissions on rides across California. Last month, it allowed

drivers in the state to see where riders were going, letting them

choose the trips they wanted to take. Shares gained 7% Tuesday.

Netflix Inc.

Foreign features are now in vogue at Netflix, where an overseas

expansion is providing more new streaming subscribers as the U.S.

slows. Netflix said Tuesday that it added 423,000 domestic

subscribers in quarter, lower than its forecast of 600,000. It beat

its expectations for subscriber growth overseas. The streaming

giant faces heightened competition from a gaggle of domestic rivals

including Walt Disney Co.'s Disney+ streaming platform and Apple

Inc.'s Apple TV+. This spring, Comcast Corp.'s NBCUniversal and

AT&T Inc.'s WarnerMedia plan to introduce their

direct-to-consumer streaming services: Peacock and HBO Max,

respectively. Shares fell 3.6% Wednesday.

Express Inc.

The fashion retailer said it would close about 100 stores by

2022, including nine stores that closed last year and 31 that will

close by the end of the month. The store closures are part of a

broader overhaul, as the company anticipates $80 million in cost

cuts over the next three years, including $55 million primarily

related to job cuts it disclosed last week. It is cutting 10% of

the positions at its Columbus, Ohio, headquarters and its design

studio in New York City. Express also said it is planning to

relaunch its loyalty and private-label credit card this fall as

part of the effort. Shares gained 21% Tuesday.

Match Group Inc.

Online dating now has an alarm. Tinder plans to start offering

users an option to hit a panic button, receive check-ins and summon

authorities to their location. To offer the service, Tinder parent

company Match Group is taking a stake and board seat in an app

called Noonlight that tracks users' locations and notifies

authorities if safety concerns arise. Tinder plans to debut the

feature free for U.S. users at the end of January. Match Group

didn't disclose the size of the investment. Shares fell 1.2%

Thursday.

Intel Corp.

Intel Corp.'s customers are clearly hungry for more chips. The

company posted strong fourth-quarter earnings that benefited from

an upswing in personal-computer shipments and robust demand for

server farms that need chips to store large amounts of data. The

results are the latest sign technology companies expect healthy

demand at the start of this year despite wider expectations for

only a modest economic rebound this year. Still, Intel is facing

challenges, including chip supply shortages, loss of market share

and turmoil from the U.S.-China trade tussle. Intel shares rose

8.1% Friday.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

January 24, 2020 19:03 ET (00:03 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

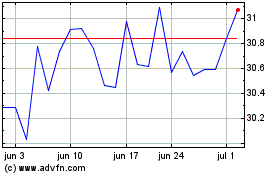

Intel (NASDAQ:INTC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Intel (NASDAQ:INTC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024