By Akane Otani

Investors who began the year feeling largely sanguine about the

stock market are struggling to make sense of whether a growing

coronavirus outbreak could upend their bets on a global economic

recovery.

Just days ago, global stocks looked poised to close out January

on a strong note. Benchmark indexes from the S&P 500 to the

Stoxx Europe 600 to India's S&P BSE Sensex climbed to records.

Investors projected that with issues including the U.S. and China's

trade war and central-bank rate increases in the rearview mirror,

the global economy would likely be able to stage a modest rebound

in 2020.

Now that view is being tested. The viral outbreak that

originated in Wuhan, China, has infected thousands and spread to

the U.S., Japan, South Korea and other countries. The disease

threatens to hamper an already-slowing Chinese economy, in turn

potentially jeopardizing the global recovery that many investors

had counted on to materialize this year.

Markets bounced higher Tuesday, paring losses after anxiety over

the outbreak sent stocks from Japan to Germany to the U.S. to their

biggest one-day declines in months Monday.

"I don't think markets anticipated how contagious this disease

has proven to be and how quickly it's spreading," said Michael

Farr, president and chief executive of investment-management firm

Farr, Miller & Washington.

Over the past several months, Mr. Farr said his firm has been

gradually selling some of its riskier investments, reasoning that

the stock market had already managed to run up well past what most

had expected in 2019.

"It really has yet to be seen whether this [downturn] will gain

traction or not," Mr. Farr said. "But it certainly seems like the

ingredients for a further decline are coming together."

Experts caution that it is still too early to understand how big

an economic impact the virus will have. So far, health officials

say the Wuhan virus appears to be less severe than prior strains,

such as the SARS coronavirus.

During prior outbreaks, markets proved resilient.

Charles Schwab analysts found the MSCI World Index declined 5.5%

in the month after January 2016, when the Zika virus spread to

several countries, but returned 2.9% over the course of six months.

In their analysis of 13 outbreaks since 1981, analysts at the firm

found the index returned an average of 0.8% over a one-month period

following an outbreak and 7.1% over a six-month period.

Morningstar analysts came to a similar conclusion, finding that,

among the companies they covered, none suffered a long-term effect

from the 2003 SARS outbreak.

In other words, even when stocks have taken a short-term hit

from disease-related worries, they have tended to bounce back in

the following months. That is because in recent decades it has been

rare, if not unheard of, for a contagious disease to bring consumer

spending to a halt around the world.

Nevertheless, the timing of this year's outbreak is in some ways

more worrisome than in prior cases. Data earlier in the month

showed China's economy grew 6.1% in 2019. While that increase was

within the government's target, it marked the slowest pace of

expansion for the world's second-largest economy in nearly three

decades.

Should the coronavirus outbreak fail to stabilize by March,

first-quarter growth in China could slow to below 6%, Société

Générale economists said in a report.

Making matters worse, the latest outbreak is spreading in the

midst of the Lunar New Year holiday, when millions of Chinese

citizens typically travel to visit their families. And China's

economy is more interconnected to the global economy than it was

when the SARS outbreak occurred in 2003, meaning a slowdown there

could have widespread ramifications.

Even just days into the deepening crisis, markets outside China

have been hit by volatility.

Copper has fallen for nine straight days in their longest losing

streak since October 2016. Prices for the industrial metal tend to

pick up when investors are more optimistic about the prospects for

economic growth.

Shares of airlines and casino operators such as Wynn Resorts

Ltd., Las Vegas Sands Corp. and American Airlines Group Inc. have

dropped, reflecting investors' anxieties about a potential pullback

in travel spending.

In the U.S., the S&P 500 ended Monday down 1.6%, marking its

worst session since October. The broad index rose 1% on

Tuesday.

Some analysts believe markets may still have further to fall

before they bottom out.

Morgan Stanley analysts predicted the S&P 500 could drop as

much as 5% before the current stretch of declines is over. That

assessment was based on the view that stocks had already run up

past what economic data justified, making them appear vulnerable to

a drawdown even before the coronavirus outbreak began.

Ultimately, though, money managers have more questions than

answers.

During the SARS outbreak in 2003, "the hit to economic growth

was measurable, albeit short-lived," said Katie Nixon, chief

investment officer at Northern Trust Wealth Management, in emailed

comments.

The extent to which the markets slide this time around will

depend on "the length, depth and breadth of the economic impact" of

the outbreak, Ms. Nixon said, adding that she would be carefully

monitoring news reports in the coming days.

Write to Akane Otani at akane.otani@wsj.com

(END) Dow Jones Newswires

January 28, 2020 18:51 ET (23:51 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

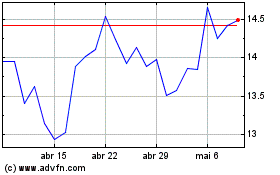

American Airlines (NASDAQ:AAL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

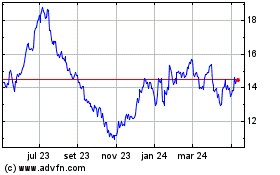

American Airlines (NASDAQ:AAL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024