RBS Pledges End to Coal Funding, Stricter Oil Rules

14 Fevereiro 2020 - 8:32AM

Dow Jones News

By Dieter Holger

The Royal Bank of Scotland Group PLC said Friday that it would

end financing for coal by 2030 and place stricter rules on

oil-and-gas majors, joining other banks that have made similar

sustainability moves as investors and the public demand action on

climate change.

"Today marks a new era," said Alison Rose, chief executive of

RBS, who took the helm in November.

RBS said it would end coal financing by 2030 and stop lending

and underwriting companies with more than 15% of their activities

related to coal by the end of 2021, unless they have a transition

plan in line with the Paris Agreement. It also pledged to halt

lending and underwriting major oil-and-gas producers without a

transition plan by 2021.

The bank, which is set to rebrand as Natwest Group PLC later

this year, said it would halve the climate impact of all financing

by 2030 and double funding for climate and sustainable finance to

20 billion pounds ($26 billion) by 2022.

RBS's move comes as the British government--and the European

Union--aims to reach carbon neutrality by 2050 and is set to host

the next global climate change conference, COP26, in Glasgow this

year. The European Commission has estimated that, including the

U.K. which has exited the EU, it could cost up to 575 billion euros

($624.4 billion) a year for the bloc's 28 member states to hit the

climate ambition, or around $18.7 trillion over the next 30

years.

"This will be a significant challenge as we, like others, do not

yet fully understand what this will require and how it will be

achieved, not least as there is currently no standard industry

methodology or approach," Ms. Rose said.

Write to Dieter Holger at dieter.holger@wsj.com;

@dieterholger

(END) Dow Jones Newswires

February 14, 2020 06:17 ET (11:17 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

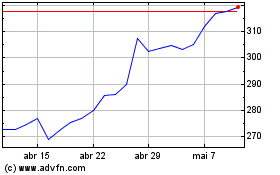

Natwest (LSE:NWG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

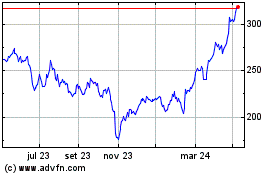

Natwest (LSE:NWG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024